Finance experts warn of BLOODY SUNDAY for Americans: Decades-high mortgage rates, student loans kicking in and Christmas spending will all pressure families this week

Decades of high mortgage rates, seasonal holiday spending and student loan payments that start again on Sunday are adding to the financial pressures Americans face.

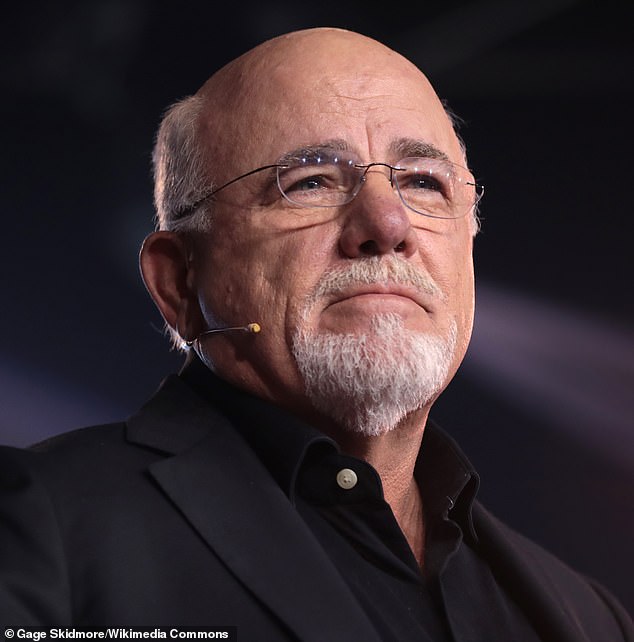

Financial expert Dave Ramsey and his team shared some advice for people looking to buy a home, as well as those looking to get through the holidays.

On a recent Fox & Friends panel, Ramsey, founder of Ramsey Solutions, said that despite sky-high interest rates, this may still be the most optimal time for some to buy a home.

“If you’re out of debt and you have an emergency fund, prices will only rise even as interest rates rise. So if you get an interest rate you don’t like, you can obviously refinance later and get out of it. But the housing market has just come to a standstill,” he said.

The nationally syndicated radio host added, as he often does, that for those facing financial stress, “it’s time to budget and make a plan.”

“We had Bloody Sunday when student loans started again on Sunday, and Christmas is upon us,” he noted.

Home mortgages have reached their highest interest rates since the year 2000, even though house prices are not falling, leaving potential buyers in a difficult situation

The current interest rate on a 30-year home loan reached an average of 7.31 percent last week, the highest figure since 2000.

The average interest rate for a 15-year fixed-rate mortgage rose last week to 6.72 percent from 6.54 percent the week before.

Ramsey’s co-host, George Kamel, spoke more directly to younger generations of shoppers and savers, saying that if “you’re a millennial, you’re Gen Z, you’re hopeless right now.” You feel cynical.’

“I want to give them some hope that it’s possible for them, but you have to put aside the FOMO because your parents say, ‘You’re throwing money away on rent, buy a house, buy a house, buy a house,’ and you you’re broke,” he said.

‘We have to be patient, because rent and mortgages are not apples to apples.

“You’ve got taxes, you’ve got insurance, HOA, PMI, the letters go on and on. So before you buy a house, make sure you’re debt-free with an emergency fund. We want you to be a homeowner, we don’t want that house to own you,” he said, adding some context to his boss’s advice.

As Ramsey said, home prices themselves, along with mortgage rates, have risen. In mid-September, the median home sales price, according to Redfin, was $374,975, up 3.4 percent year over year.

The increase has pushed average monthly home payments to a record high of $2,661.

With costs skyrocketing and no end in sight to the inflation crisis, the Ramsey team continually emphasized the importance of creating and maintaining a personal budget.

“You want to be able to say, OK, I’m going to plan in advance, I’m not going to let this sneak up on me,” Ramsey expert Rachel Cruze said of the upcoming holiday shopping season

“If you’re out of debt and you have an emergency fund, even if interest rates go up, prices will only go up,” Ramsey told potential homebuyers.

“Before you buy a house, make sure you’re debt-free with an emergency fund. We want you to be a homeowner, we don’t want that house to own you,” said Ramsey co-host George Kamel.

Ramsey’s team advised holiday shoppers to stick to a strict, pre-planned budget for friends and family

Rachel Cruze, a financial expert from Ramsey, and Dave’s daughter, said, “You want to be able to say, OK, I’m going to make plans in advance, I’m not going to let this creep up on me.”

“So again, budgeting is huge when it comes to this… So be diligent and be honest with your friends and family as well. Like inflation has hit you and you’re going to be tight this month, or next month at the end of the year, be honest about that and just say, hey, Christmas might look different.”

Jade Warshaw, another member of the Ramsey team, said that while budgeting is viewed negatively by some, it actually “gives permission to spend money.”

“It helps you look at your money and see, OK, this is what I can do with my money, I can enjoy the holidays,” she said. “But I want to add, when it comes to the holidays, I like to give people permission to do the least. Everyone is doing their best and I think: go small. You don’t have to have 50 parties and 50 gifts. Do it small or don’t do it at all.’

Dr. John Delony, mental health expert on the Ramsey team, said that today’s generation of homebuyers and budget investors are notoriously anxious and that a good way to alleviate some of that anxiety is to move away from material gifts.

“A great gift we can give to our children is not more stuff,” said the author of “Building a Non-Angious Generation.”