People in London, Scotland and the East are most at risk of poverty in retirement

People in London, Scotland and the East are most at risk of poverty in retirement

- About 39% have difficulty paying basic bills as they get older for certain reasons

- People in Northern Ireland and the West Midlands are best prepared

- How do you arrange your pension if you are afraid that things are not going well? Read it below

Londoners and Scots are among those most at risk of falling into trouble in old age, a breakdown of current pension savings in the UK shows.

Nearly two in five people in those parts of the country, and in the east and north-east of England, could struggle to keep up with household bills in retirement.

People in Northern Ireland and the West Midlands are best prepared for old age, although no region has an overwhelming number of people in a financially advantaged position, according to Scottish Widows research.

UK breakdown of preparing for old age: Find out how to get YOUR savings on track below

The company used its previous research into potential retirement outcomes for people aged 22 to 65 to look at the regions where people are doing the best and the worst.

It surveyed more than 5,000 nationally representative adults and around 1,350 people from ethnic minorities, projecting their likely retirement income against benchmarks in an influential sector survey.

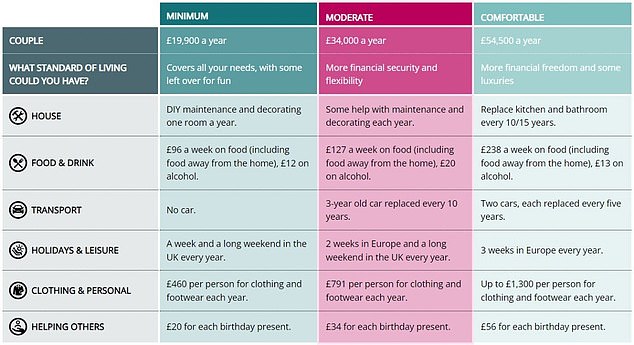

The Pensions and Lifetime Savings Association’s standard of living measure is based on different packages of goods and services, such as food and drink, transport, holidays, clothing and social outings.

It showed that an individual needs £12,800 a year for a basic lifestyle, £23,300 to meet moderate needs, and £37,300 for a comfortable old age.

Scroll down to find out what these income levels get you and what couples need. The PLSA excludes housing costs, although Scottish Widows has included this in its own research.

Scottish Widows found that almost 39 percent of people in London, Scotland and the East and North East of England were on their way to less than the minimum income in old age. People in this group are likely to struggle to afford basic necessities such as food and heating.

STEVE WEBB ANSWERS YOUR PENSION QUESTIONS

The company says that, perhaps unexpectedly, the data shows no clear north-south divide in the extent to which people are preparing for retirement.

“However, there are possible explanations offered by the National Retirement Forecast,” the report says.

‘Not only are retirees in London, for example, more likely than people elsewhere to rent their home (35 percent versus 30 percent), but they are also likely to see rental payments eat up a UK 131 percent of their retirement income. .

‘Similarly, rents will make up 98 per cent of the retirement income of those in the east of England.

‘The poor pension prospects in the North East and Scotland, meanwhile, are likely to be a product of employment patterns.

‘These regions have historically had lower average incomes and employment rates than the rest of Britain, threatening the ability of people in these regions to save enough for retirement.’

Pete Glancy, head of policy, added: ‘The uncomfortable truth is that people in the UK are failing to save enough for their retirement and some are carrying on without realizing that they could take some simple steps to make a big difference to their financial future.

‘Looking so far ahead makes it difficult for many people to set priorities. Looking at your pension realistically is not as difficult as it seems. It’s as simple as checking how much you have in your pot, whether it’s enough for the retirement you want and what you can do next to put yourself in the best position when you retire.

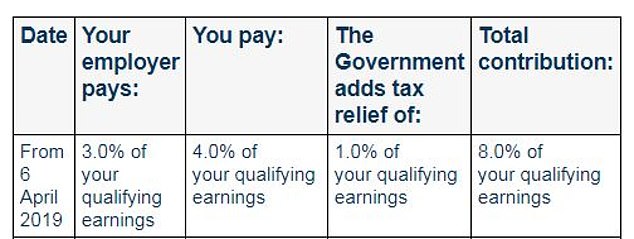

‘We recommend that people save at least 15 percent of their salary if they can afford it for their retirement, including employer contributions and tax relief (see below for the minimum for auto-enrolment, which totals 8 percent of salary).

“Even though this may feel beyond your means, taking steps to figure out what you have, if it’s enough, and what options you have is a big step in the right direction.”

> How do you arrange your pension if you are afraid it will fall short? Read it below

Who pays what: Automatic breakdown of minimum pension contributions for taxpayers at this time. Contributions are based on a range of your earnings between £6,240 and £50,270, but some employers are more generous.

Retirement Income Needs for Singles (Source PLSA)

Retirement Income Needs for Couples (Source PLSA)