Home buyers get 4% discount on asking price worth £12k, Zoopla says

According to Zoopla, property prices in Britain fell by 0.5 percent in the past year, marking the first time they have fallen in a decade.

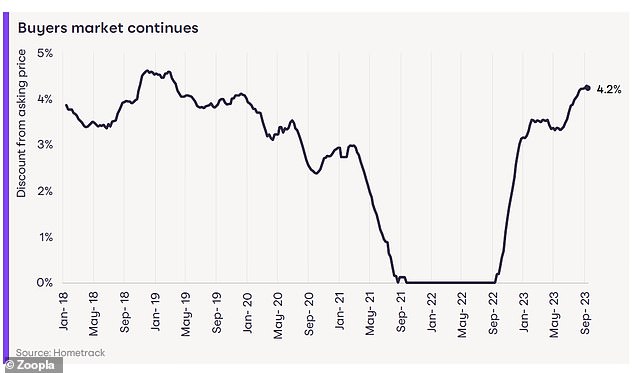

Buyers are also taking advantage of the current market and are looking for further discounts, according to the property portal’s latest house price index.

The data shows that on average they shave £12,125, or 4 per cent, off the asking price of a property.

With discounts at the highest level since March 2019, buyers in London and the South East of England are getting the biggest cuts, according to Zoopla.

Get that discount: Buyers get an average of £12,125, or 4 per cent, shaved off the asking prices of UK properties, Zoopla said

Zoopla said there is ‘still a buyer’s market’, with some buyers unwilling to compromise on what they want in the face of higher borrowing costs, or waiting for price drops and lower mortgage rates.

Further “modest” falls in house prices are expected in the coming months and early next year, the report said.

Mortgage interest rates are also expected to fall further in the coming weeks, but not significantly until next year.

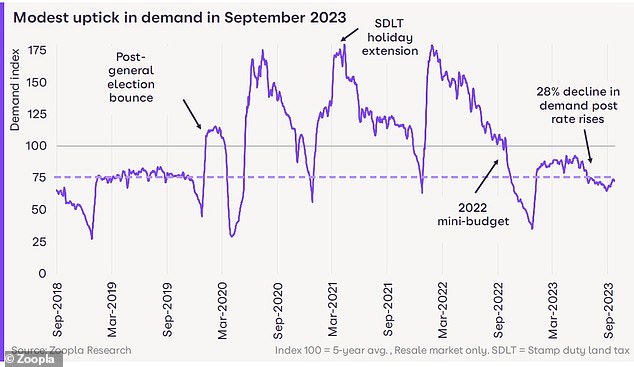

Property sales this year are expected to be 20 percent lower than last year, and 28 percent lower for those buying with a mortgage, the online real estate portal said.

It said: ‘Many households have postponed their moves, while more fixed-rate loans, stricter affordability tests and a robust labor market mean there are few forced sellers in the market.’

Zoopla said it expects to record a ‘small’ month-on-month decline in property prices in the autumn and end the year between two and three per cent lower than 2022.

As a result, average prices would be 17 percent higher than in the first quarter of 2020.

Time to buy? Zoopla said it is a buyer’s market in Britain, with asking prices being discounted

It added: ‘The modest decline in house prices is not sufficient to increase affordability and support a recovery in sales volumes, even if mortgage rates were to fall below 5 per cent.

“We can expect further modest downward pressure on prices in the fourth quarter of 2023 and in the first quarter of 2024.”

It said the impact of higher borrowing costs on pricing was modest compared to the size of the hit to purchasing power.

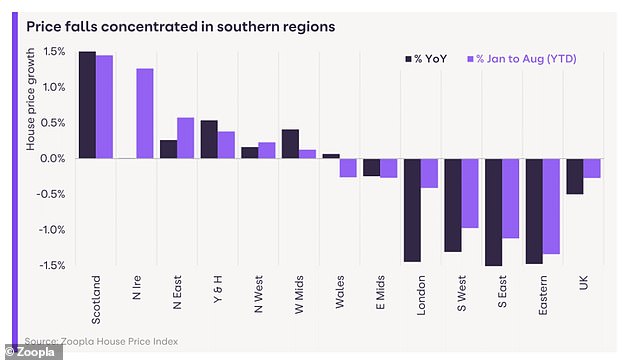

The fall in house prices has been concentrated in southern England, where higher mortgage rates have had a greater impact on pricing, according to Zoopla.

Price shifts: Declines in property prices are mainly seen in the southern regions of the UK

In London, property prices have fallen by 1.4 percent to £541,800 in the past year. In the south-east and east of England, prices have fallen by 1.5 percent in the past twelve months.

In contrast, in Scotland, where prices are 40 percent below average, annual house price growth is 1.6 percent.

Discounts on asking prices are largest in London and the South East of England at 4.8 percent, compared to 2.8 percent in the rest of Britain.

Zoopla said demand had improved across all regions of Britain, rising 12 percent in September, adding that agreed sales also rose.

Question: Zoopla said demand in the UK property market increased in September

Mortgage rates fall below 5%, says Zoopla

Zoopla’s findings suggest that recent better-than-expected inflation news and a pause in base rate increases have weakened expectations about the trajectory of future borrowing costs.

Looking ahead, Zoopla said: ‘Across Britain’s largest lenders, the average five-year 75 per cent fixed rate loan currently averages 5.1 per cent.

‘We expect mortgage interest rates to slowly fall further to the high four percent in the coming weeks.

However, uncertainty remains about the path of inflation and how quickly it will return to the Bank of England’s two percent target.’

The closer mortgage rates get to four per cent, the more buyers will come back into the market, which will support sales and price levels, Zoopla claims.

It said: ‘The faster the average mortgage rate (for a five-year fixed LTV rate of 75 percent) moves toward 4.5 percent or lower, the sooner we will see buyers return to the market. That currently seems more likely in 2024 than later this year.”

Home sales volumes are on track to reach a total of 1 million in 2023, a fifth less than in 2022, the report said.

Richard Donnell, executive director of Zoopla, said: ‘The housing market continues to adapt to an environment of higher mortgage rates.

‘Better news on inflation and the end of base rate increases have given lenders room to start cutting mortgage rates, which has supported a modest increase in housing demand in September.

‘Buyers remain cautious and many are waiting for better value for money and greater affordability from lower house prices or further falls in mortgage rates before returning to the market.’

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.