Moody’s warns that a government shutdown could threaten the country’s top credit rating – making it the final major agency to strip the US of its highest score

Credit rating agency Moody’s has warned that a government shutdown could damage US creditworthiness.

While it said a short-term shutdown would be “unlikely to disrupt the economy,” it would underline “the weakness of U.S. institutional and governance strength” compared to other top economies.

Moody’s is the last major rating agency to still give the US the highest rating of AAA.

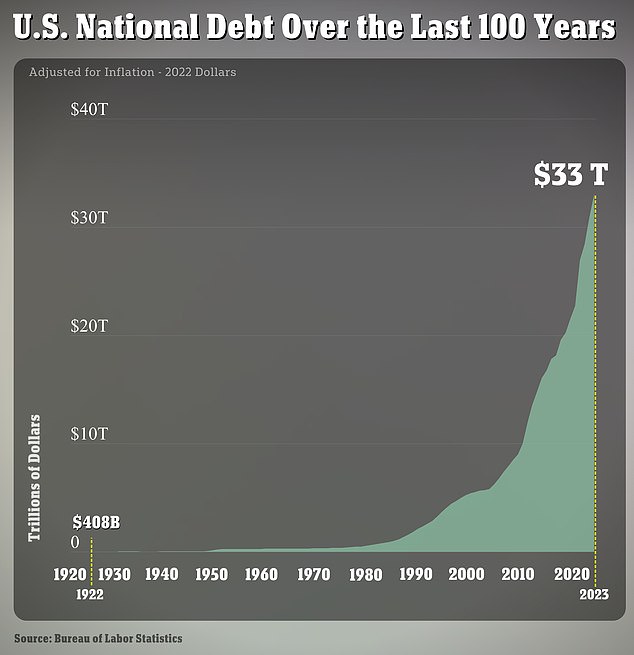

Last month, Fitch, another major ratings agency, downgraded the U.S. rating to AA+ from AAA, citing the country’s $33 billion debt and “a steady deterioration in governance standards.”

On Monday, Moody’s echoed that sentiment, saying a shutdown would highlight the constraints that “intensifying political polarization places on fiscal policymaking at a time of declining fiscal strength.”

Credit rating agency Moody’s said a government shutdown would damage U.S. credit, saying it would be a sign of poor and polarized governance.

Congress has so far failed to pass spending bills to fund federal agency programs, which would result in a shutdown starting Oct. 1

“Looking ahead, weaker fiscal policy, leading to persistently high budget deficits and higher-than-expected interest costs, would put pressure on the U.S. rating or outlook,” Moody’s wrote in a statement.

If Congress fails to provide funding this week for the new budget year, which begins Oct. 1, government services would be disrupted and hundreds of thousands of federal workers would be laid off without pay.

Moody’s analyst William Foster told us Reuters the shutdown would be evidence of Washington’s weak policymaking in the face of financial pressures caused by high interest rates and the country’s significant $33 billion debt burden.

“If there is no effective fiscal policy to offset these pressures… it is likely to have an increasingly negative impact on the credit profile,” Foster said.

“And that could lead to a negative outlook, and possibly a credit downgrade at some point, if those pressures are not addressed.”

Moody’s rates the US government as AAA with a stable outlook – the highest credit rating it assigns to economies.

“Fiscal policy in the US is less robust than in many other AAA-rated countries, and another shutdown would be further evidence of this weakness,” Moody’s said.

President Joe Biden’s top economic adviser, Lael Brainard, said Moody’s comment underscored the importance of Congress reaching a deal.

“Today’s statement from Moody’s underscores that a Republican shutdown would be reckless, create completely unnecessary risks to our economy and lead to disruptions for communities and families across the country,” Brainard, director of the National Economic Council, said in a statement. a statement.

“Congress must do its job and keep the government open.”

A Treasury spokesman said the Moody’s report “provides further evidence that a shutdown could undermine our current economic momentum” at a time when inflation and unemployment were both below 4 percent.

Since President Biden and House Speaker Kevin McCarthy agreed to suspend the debt ceiling in June, the budget deficit has increased by $1.58 trillion.

The US national debt has topped $33 trillion for the first time, as Congress heads for a shutdown

Moody’s said the economic impact of a shutdown is likely to be limited and short-lived, with the most immediate effect coming from lower government spending, and that the negative impact will increase the longer the shutdown lasts.

Congress has so far failed to pass spending bills to fund federal agency programs amid a feud between the Republican Parties. The closure would not affect national debt payments.

Earlier this year, the political battle over lifting the US debt limit threatened to lead to a default on the US government debt.

Although the crisis was ultimately resolved before any debt payments were missed, it was a major factor leading to Fitch’s credit rating downgrade last month.

“In this environment of longer interest rates and increasing pressure on debt affordability, it is much more important that fiscal policy can respond,” said Moody’s Foster.

“And it looks increasingly challenged because of things like the government shutdown and the fact that the debt limit has been lifted, because there are such polarized political dynamics in Washington,” he said.