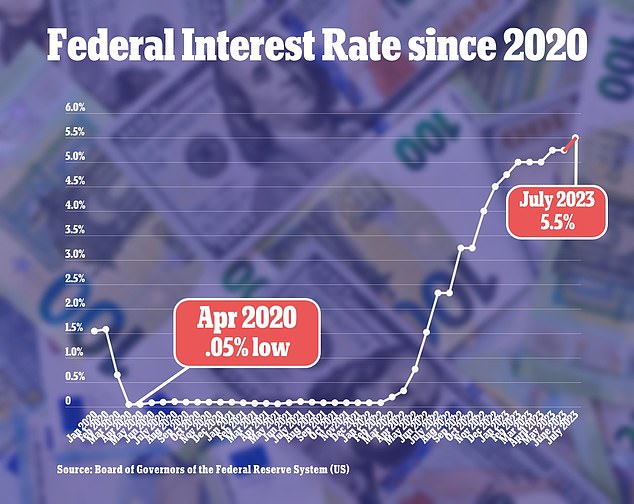

Monthly average payments for homeowners stand at $2,161 – an increase of $1,000 since before the pandemic – as Fed Chair Powell continues to hike rates in struggle to tamp down inflation

Monthly average payments for homeowners are $2,161 — up $1,000 since before the pandemic — as Fed Chairman Powell continues to raise rates in his fight to keep inflation in check

- Homeowners are feeling the pressure after the Fed warned of more pain

- Average monthly payments were just $1,151 in May 2020

- But eleven consecutive increases in the base interest rate have left millions of people struggling to pay

Mortgage costs for the average family have almost doubled since the start of the pandemic, after interest rates reached a 20-year high.

According to the Mortgage Brokers Association, the average monthly mortgage payment for a U.S. home rose from $1,191 in January 2020 to $2,161 in July of this year.

The increase follows eleven consecutive increases in bank interest rates as the government struggles to keep rising prices under control.

Hopes for a reprieve rose as the Fed kept bank rates at 5.25 to 5.5% after its September meeting last week as it waited to see if the hikes work.

And while inflation has fallen from a peak of 9.1 percent in June last year, it has crept back up in the past three months, prompting policymakers to warn mortgage payers to expect another increase before the end of the year.

Federal Reserve Chairman Jerome Powell has warned homeowners that more mortgage rate hikes may be coming

Dailymail.com explains how brutal interest rate hikes have burned a hole in household budgets

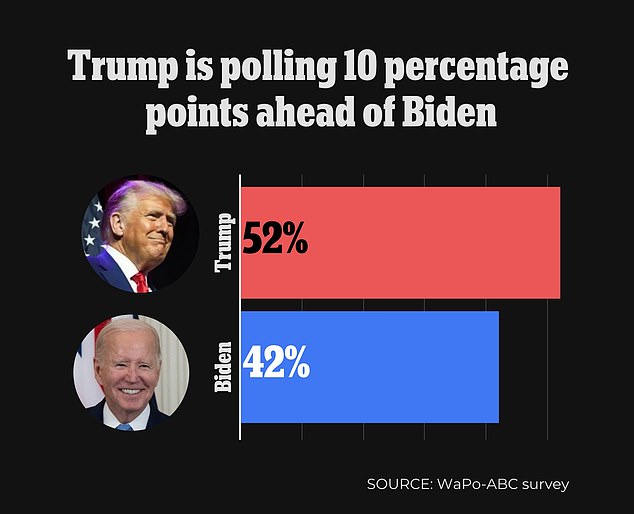

The economy helped Donald Trump to a record lead over President Biden this weekend

“We really want to see compelling evidence that we’ve gotten to the right level, and we see progress and we welcome that,” said Fed Chairman Jerome Powell, who was appointed by former President Donald Trump in 2018.

“But you know we need to see more progress before we’re willing to come to that conclusion,” he said.

The government blames inflation shortfalls due to the global shutdown during the pandemic, as well as the impact of the war in Ukraine on Russian energy supplies.

Labor shortages, stimulus checks from both the Trump and Biden administrations, along with a $1.9 trillion coronavirus relief package were also blamed for overheating an economy that rebounded strongly after lockdowns were lifted.

The president has sought to turn criticism of “Bidenomics” on its head as the economy looks set to play a central role in next year’s general election.

“Republicans in the House of Representatives think big corporations and the wealthiest Americans need a tax break,” he tweeted today.

“I think it’s time for working people to see some relief, and for the wealthiest to pay their fair share.”

But it comes as polls show him with the worst ratings of his presidency, trailing his likely opponent Donald Trump by nine percent in an ABC/WaPo sample this weekend.

And the president’s approval rating on the economy has fallen to just 30 percent.

“Biden’s approval rating on jobs is 19 points underwater, his ratings on handling the economy and immigration are at career lows,” ABC wrote in its analysis.

“A record number of Americans say they have been made worse off under his presidency, three-quarters say he is too old for another term and Donald Trump looks better in retrospect – all serious challenges for Biden in his upcoming re-election campaign.”

The rise in mortgage costs was followed by rising house prices, which rose from $322,000 to $479,000 in the two years to the end of last year.

But they have since fallen to $416,000 as higher bank rates have deterred buyers, prompting analysts to warn of a “mortgage time bomb” with millions trapped in homes they can no longer afford.

US borrowers now owe a record $43 billion on credit cards, and Missouri Senator Josh Hawley has demanded an 18 percent cap on the interest charged on them

Eleven consecutive increases in the Federal Reserve’s base rate have pushed household borrowing costs to their highest level in more than two decades

Adding to the misery is the record level of credit card debt, which now averages $10,170 per household, following the second largest increase on record.

Americans now pay 28 percent interest on $43 billion in credit card debt, prompting calls for a lower limit on what lenders can charge.

“They’re actively encouraging and finding new ways to get consumers into debt — they’re raising interest rates, and they can make a killing doing it,” said Republican Sen. Josh Hawley of Missouri.

“The government was quick to bail out the banks this spring, but ignored the working people who were struggling to get ahead.”