GUINNESS GLOBAL INNOVATORS: Approach gives 200% return

GUINNESS GLOBAL INNOVATORS: Approach delivers 200% return

Investment fund Guinness global innovators makes money for investors by taking stakes in companies involved in cutting-edge technology – everything from artificial intelligence and clean energy to robotics and automation.

It is an investment strategy that fund managers Matthew Page and Ian Mortimer have been working on for fourteen years and are gradually refining it.

Of the £720m of assets they manage for investors under this theme, just over £600m is in the fund.

So far, the results indicate that the formula is working a treat. Since its launch at the end of October 2014, the fund has achieved a return of 200 percent.

This compares with the 120 percent gain generated by the average global investment fund and the 170 percent gain achieved by the FTSE World Index.

While the managers’ investment approach focuses on identifying top companies operating in sectors that drive both economic growth and transformation, this does not carry as much risk as it may seem.

There are a number of checks and balances built into the portfolio to ensure it remains diversified, not overly reliant on specific investments, and does not have a long string of failed holdings.

Therefore, when a new company is added to the portfolio, an existing share must be sold – with the number of holdings remaining constant at 30. This ensures that the fund focuses very strongly on the best ideas of the managers.

At the end of last month, the fund sold its stake in US pharmaceutical giant Bristol Myers Squibb – and took a position in Danish rival Novo Nordisk.

Any companies held by the fund must also fit within the nine investment themes that Page and Mortimer have identified as key drivers of growth. When purchased, they must also have a market capitalization of at least $1 billion (£807 million).

Unlike rival funds such as the Scottish Mortgage investment fund, it avoids early-stage growth companies that can lead to both large losses and spectacular profits.

Finally, the managers aim to maintain equal portfolio holdings in all thirty companies, although the strong price performance of a specific stock will often cause this to get out of hand in the short term.

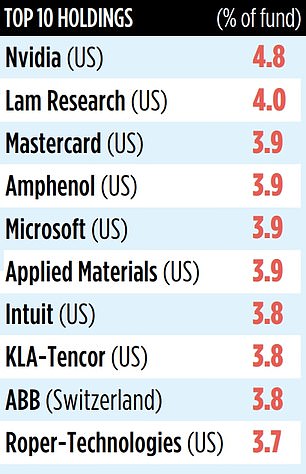

For example, US software giant Nvidia is currently the fund’s largest holding at 4.8 percent, as a result of its strong share price return (up 83 percent in the past six months).

The managers will trim the position if it reaches five percent. Bets that do not perform well will be removed. “We don’t water weeds,” says Mortimer.

The result is a fund with names that are familiar to most consumers – such as Alphabet, Apple, Mastercard and Nike. The country is also America-centric, with 80 percent of assets in US-listed companies. There are no British holding companies.

“If you want to invest in growth companies,” says Mortimer, “the options in Britain and Europe are limited. Because there are few such companies in these markets, their valuations are often expensive compared to U.S. rivals.”

While Mortimer is happy with the way the fund has performed, he is not complacent. “In the investment world, nothing can be taken for granted,” he says. ‘But a good starting point for successful investing is identifying growth themes. If you can then find the companies that are best positioned to benefit from these themes, you will be in a good position.”

The fund has annual ongoing charges of 0.84 percent. Page and Mortimer also oversee a global equity income mandate for Guinness Global Investors, a company with assets of more than £7 billion.