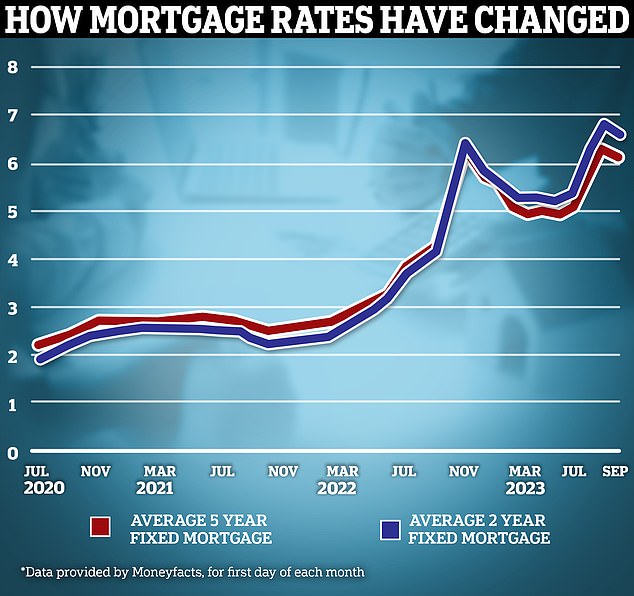

Fixed mortgage rates fall below 5% for the first time since July

Fixed-rate mortgages have fallen below 5 percent for the first time since early July, offering hope to struggling homeowners.

Yorkshire Building Society has launched a 4.99 per cent fixed rate deal available to both homebuyers and those refinancing.

It is available at a Loan-to-Value value of 75 percent, meaning eligible customers can apply as long as they have at least a 25 percent down payment or 25 percent equity in their home.

Best rate: Yorkshire Building Society has launched a 4.99 per cent fixed rate deal, aimed at both homebuyers and those taking out new mortgages

Someone with a £200,000 mortgage could expect to pay £1,168 per month if repaid over 25 years, compared to the market average of £1,249 per month.

However, the five-year deal comes with a fee of £1,495, and a mortgage with a higher interest rate but a lower fee may be a better deal for some customers.

With our calculator you can compare rates and costs and calculate the actual costs of a mortgage.

After Yorkshire BS, Virgin Money is the next best deal, with a five-year fix of 5.07 per cent and available to homebuyers who buy with a deposit of at least 35 per cent (65 per cent loan-to-value).

HSBC applies a five-year interest rate fix of 5.09 percent for home buyers with a down payment of at least 40 percent (loan-to-value of 60 percent).

Nationwide also has a 10-year fix at 5.04 percent available, which is available to homebuyers with a down payment of 15 percent or more (85 percent Loan-to-Value).

According to Rightmove, the average five-year fixed mortgage rate is now 5.67 percent.

Rachel Springall, finance expert at Moneyfacts, said: ‘It’s great to see such competitive deals launched by Yorkshire Building Society.

‘Borrowers looking for a new low interest mortgage will find the five-year fixed deal at less than 5 per cent to be the lowest interest rate available in their sector.

‘The incentive packages available today on all new deals could also be popular with borrowers looking to save on the upfront cost of their mortgage.’

Why are mortgage rates going down?

Yorkshire BS’s decision to cut rates, which will see up to 0.46 percentage points removed from its 95 per cent loan-to-value deals, is partly due to competition between lenders.

HSBC also today cut mortgage rates by an average of 0.15 percentage points, alongside rate cuts across the buy-to-let range of up to 0.3 percentage points.

Last week there were also cuts at Coventry BS, Nationwide BS, Accord, Generation Home, Barclays and Clydesdale Bank.

Past the peak? Fixed mortgage rates appear to be retreating somewhat after a barrage of rate hikes in recent months

Rate cuts have also been encouraged by future market expectations about the direction of interest rates.

Market expectations are reflected in the swap rate. These are agreements where two counterparties, for example banks, agree to exchange a stream of future fixed interest payments for a stream of future variable payments, on a fixed amount basis.

Mortgage lenders enter into these agreements to protect themselves against the interest rate risk associated with providing fixed-rate mortgages.

Put more simply, swap rates reveal what financial institutions think the future holds in terms of interest rates.

Five-year swaps are currently around 4.56 percent, down from 4.74 percent at the start of this month.

Only in July were five-year swaps above 5 percent. Similarly, the two-year swap rate is now 5.21 percent. At the beginning of July this was around 6 percent.

Ben Merritt, director of mortgages at the Yorkshire Building Society, said: ‘This week, favorable market swap rates provided just such an opportunity to reduce our mortgage costs, and provide the biggest boost to those people who typically struggle most, those on the lowest incomes . deposits to put down, also for starters.’

Nicholas Mendes, mortgage technical manager at estate agent John Charcol, says he would not rule out a five-year rate fix of 4.5% by the end of the year

Will mortgages be increased again if the base interest rate rises?

The Bank of England is widely expected to raise the base rate to 5.5 percent from 5.25 percent on Thursday, although some economists are betting it will remain the same.

The decision will come the day after we know the August inflation figures, which many expect to rise due to higher fuel prices. This may have some influence on what the Bank of England decides to do with the base rate.

If the base rate rises, it will likely increase costs for those with variable rate mortgages.

However, this is unlikely to have the same impact on fixed-rate products, according to Nicholas Mendes, mortgage technical manager at broker John Charcol. In fact, he expects fixed interest rates to continue to fall.

“It is expected that the MPC meeting will remain or increase by 0.25 percent, which will undoubtedly be the last (rate increase),” Mendes said.

‘Even if there is a rate increase, it has already been incorporated into fixed rates.

“As a result, I expect fixed rates for two- and five-year fixes to continue to decline.

“While no one can be sure, based on the current price trajectory, I wouldn’t rule out a five-year fixed rate of 4.5 percent by the end of the year.”

What influence does mortgage interest rates have on the housing market?

Although it is good news that mortgage rates are falling, we are still a long way from the low interest rates of previous years.

This time last year it was possible to obtain a fixed interest rate of 3 percent and the year before that borrowers could get deals at less than 1 percent.

It’s no surprise that the change in mortgage rates has had an impact on the housing market. The number of transactions has fallen by almost 20 percent, while house prices are also falling.

Last week it was reported that mortgage arrears had reached the highest level in almost seven years.

According to figures from the Bank of England, the value of outstanding home loans in arrears increased by 13 percent to £16.9 billion in the second quarter of this year.

It was the highest level since the third quarter of 2016 and 29 percent higher than the same period a year ago.

Although there may be less activity in the housing market, Mendes does not expect a sudden increase in foreclosures.

“Mortgages with a fixed rate of around 5 percent may dampen buying demand as potential movers postpone their plans, but I still expect first-time buyers to continue buying,” he says.

‘As rental prices continue to rise, fixed rates of 5 per cent or less could encourage more first-time buyers and those in rental properties to buy as a cost-effective alternative.

‘A significant increase in payment arrears was borne by landlords, which is understandable in this climate over the past year.

Downward: Mortgage rates have continued to decline in recent weeks due to competition among lenders and market expectations about future interest rates

‘For private homeowners there are more options to avoid payment arrears – unless they decide to bury their heads in the sand.

‘There is more support from lenders and the Mortgage Charter, which allows a six-month grace period, allowing mortgage holders to sell a property before things start to escalate downwards.’

Mark Harris, CEO of mortgage broker SPF Private Clients, says falling mortgage rates will mean buyers can afford larger mortgages, which should lead to an increase in transactions.

Harris added: “Falling interest rates could encourage more borrowers to take the plunge and take out a mortgage. However, it is not only about the falling mortgage interest rate, but also about the affordability and acceptance of the loan.

‘Lenders are still required to stress test loans at a minimum of 1 per cent above the reversion rate, with some lenders offering various lower interest rates for longer/longer term solutions.

“When these stress rates also begin to decline, borrowers will be able to take out larger mortgages, which could lead to an increase in transactions and mortgage lending.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.