America’s bargain property hotspots revealed: The 15 cities where homes are cheap now – but prices are going up

America’s Bargain Hotspots Revealed: The 15 Cities Where Homes Are Cheap Now, But Prices Are Rising

Rumors of a real estate crash have been circulating for months, but house prices continue to float against all odds.

Zillow economists predicted in July that home prices will rise 5.8 percent by the end of 2023 from their beginning. And a separate index from the National Association of Realtors showed that real estate prices rose again last month.

But with so much uncertainty ahead, current buyers may want to think hard about whether a new home is going to guarantee them a profit.

Personal financial experts at GoBanking Rates conducted a survey this month to find the best cities for “bargain homes” – meaning they are now low in value but steadily rising.

Using February 2023 data from Zillow, the analysis looked at home prices in each city, how much they had risen over the past year, and how much lower they were compared to the rest of the state.

Personal finance experts at GoBankingRates conducted a survey in the US this month to find the best cities for ‘bargain housing’ – meaning they are now low in value but rising

It named Midland, TX, Englewood, OH, and Cicero, IL, among the top real estate hotspots — though they weren’t officially ranked.

In Midland, a typical single-family home is worth $276,294 — about $14,900 less than the median home value in the rest of Texas.

Yet this gap is narrowing as Midland saw house prices rise by $2,528 between February 2022 and 2023.

Similarly, in Englewood, the median single-family home is worth $193,457, up $7,978 from the previous year.

In Cicero, homes are now worth $225,208, compared to $222,638 in 2022.

The vast majority of cities GoBanking Rates The identified companies are located in the South and Midwest regions.

It’s because Americans now face worse housing affordability than they did in 2006, as buyers face a perfect storm of high mortgage rates and higher home prices.

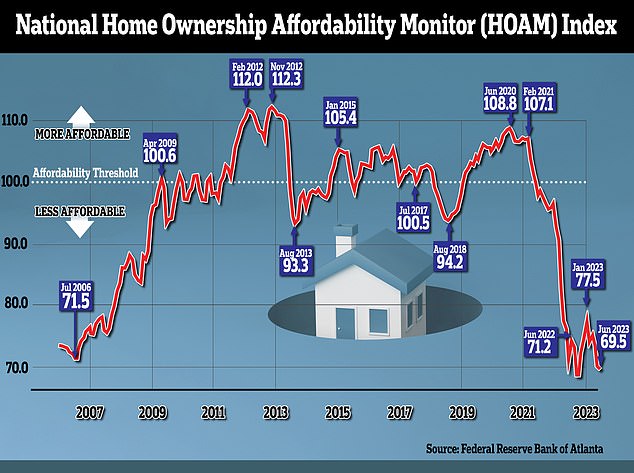

Since 2006, homebuyers have faced the least affordable market, according to data from the Atlanta Federal Reserve

Zillow economists recently predicted that home prices would rise another 5.8 percent before the end of the year, bringing the median real estate to $370,754.

Data from the Atlanta Federal Reserve shows that affordability has fallen below the peak of the housing bubble leading up to the 2008 financial crisis.

The Atlanta Fed uses home prices, mortgage rates and median incomes to calculate an “affordability” score each month. The latest figures, from June 2023, show that the score has dropped to 69.5 – almost 40 points lower than in June 2020.

Leading economist Fred Harrison, who accurately predicted the last two global real estate crashes, recently told DailyMail.com that the US will not experience a real estate collapse until 2026.

Harrison is a pioneer of the “18-year house price cycle theory,” which claims that a crash does not happen until 18 years after the onset of the last crash.

His hypothesis, based on 1930s research on Chicago business cycles, has yet to prove him wrong.

His most recent book We Are Rent claims that prices will peak in 2026 before a recession that will overshadow the events of 2008.