Mark Bouris warns house prices could fall as unemployment rate rises and Aussies struggle with mortgages

A leading financial guru has warned that rising unemployment will pose a bigger threat to the real estate market than resetting fixed-rate mortgages.

Australian businessman and chairman of Yellow Brick Road home loans Mark Bouris has tipped house prices as more people lose their jobs, while the unemployment rate is expected to reach 4.5 percent next year.

More than 1.3 million Australian households will see their mortgages adjusted by the end of 2024, as their current fixed-rate mortgages expire.

Mr Bouris believes mortgage holders are coping better than expected despite the Reserve Bank of Australia making 12 consecutive rate hikes since May 2022.

But he believes more Aussies will be forced to sell their homes as the job market weakens.

According to Mark Bouris, housing supply in Australia is expected to increase ‘rapidly’ as unemployment in Australia rises. Pictured is an auction in Melbourne

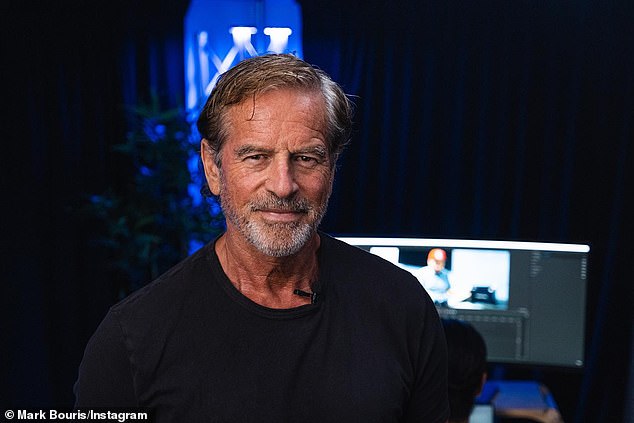

According to Mark Bouris, house prices will fall as more people lose their jobs (pictured)

Australia’s unemployment rate rose to 3.7 percent in July, up 0.2 percent from a month earlier and the highest since May 2022.

The price is expected to rise 4.5 percent next year, once the impact of interest rate hikes has flowed through the economy.

“If the unemployment rate rises to 5 percent, we will see more supply entering the market, while demand continues to stagnate,” Bouris told the newspaper. Australian financial statement.

“This could lead to a reversal of recent price gains.”

Mr Bouris said the number of houses on the market will start to increase within the next six to nine months.

“I think some people will be forced to sell if their fixed mortgages are reset to higher interest rates so we can see more supply over the next six to nine months, but it is unlikely that this will be enough to let prices fall,” he said.

“But if you link that to higher unemployment, then we will see supply increase quite quickly.”

The Reserve Bank left interest rates unchanged on Tuesday for the third month in a row at the highest level in eleven years, namely 4.1 percent.

According to CoreLogic, house prices nationwide have risen 4.9 percent since February.

In Sydney, the average value rose another one percent to an even more prohibitive figure of $1,333,985 in July, CoreLogic data showed.

House prices started to rise again in March in other major capitals.

House prices in Melbourne have risen for five consecutive months, rising a further 0.3 percent to $923,881 in July.

In Brisbane, house prices rose another 1.4 percent to $819,832. Perth’s values rose 1 percent to $625,969.

Mr Bouris said the number of houses on the market will start to increase within the next six to nine months

Australian unemployment is expected to rise to 4.5 percent next year. Pictured are Aussies outside Centrelink

Adelaide’s recovery began in April, but monthly increases have been bigger since then, with prices rising a further 1.4 percent to $722,793 in July.

Darwin prices rose for the third straight month in July, rising 0.5 percent to $583,913.

“The lack of supply tells me that people don’t have to sell because they still have jobs, and that as a result of not having to sell, higher interest rates have not yet put pressure on prices,” Bouris added.

He correctly predicted that interest rates would remain unchanged on Tuesday after annual inflation fell from 5.4 percent to 4.9 percent in July.

“That’s very encouraging,” Bouris told Sunrise on Tuesday.

“That’s one of the lowest numbers we’ve had in a long time. Good stuff.’

“In terms of when a rate cut will happen, I think they’re going to have a hard time making sure they teach us a lesson about not overspending or overpaying and getting our household expenses under control for a while. to hold.

The money market generally expects the start of interest rate cuts around July, August, let’s say around this time next year.

“So we’re looking at a year from our current rate, then some relief after that.”

By the end of 2024, 1.3 million Australian households will have their mortgages adjusted, forcing some to sell their homes. Pictured are potential homebuyers at an auction in Sydney