Financial planners reveal the ten assets you should NEVER leave to your heirs – that could make your family worse off

American families are increasingly facing financial difficulties when it comes to organizing their inheritances.

Last month, the IRS quietly changed the rules around estate taxes, putting family members at risk of getting caught.

And it comes at a time when families are preparing for the so-called “Great Wealth Transfer,” as estimates suggest that baby boomers will pass a record-breaking $53 trillion to their children by 2045.

But experts insist that such problems can be avoided as long as parents are clear about what they want to pass on to their children.

DailyMail.com spoke to three financial planners about the assets that could make your heirs worse off if you pass them on.

Financial planner and therapist Khwan Hathai recommends not passing on properties with high maintenance costs.

Chad Holmes, left, says you should never gift a house while you’re alive, while Alex Doyle, right, recommends individuals not to pass on complicated investments like cryptocurrencies.

Certified planner Khwan Hathai, who leads Epiphany Financial Therapysaid, “The usual approach is to accumulate wealth and possessions, but what about eliminating possessions that could become a burden?”

Among the assets she advises not to pass on is a property with a high maintenance cost, as such assets “could deplete rather than boost your heirs’ finances.”

These are often large estates or even vacation homes that loved ones can lump together with current expenses that drain their finances.

Instead, the original owners should consider selling the property before they pass away, or even converting it into a rental property so that it can generate passive income for their heirs.

In extreme cases, they can even be donated to charitable organizations.

Hathai adds that business owners should think twice about passing their businesses on to their heirs.

She said: ‘Owning a specialty business may not be the best asset to pass on if your heirs don’t have the expertise or interest to do so. Instead of a gift, it becomes a complex problem for them to solve.’

Alex Doyle, van Woodson Asset Managementadds that investors should avoid transferring their most complicated investments.

These include ‘illiquid investments’, meaning investments that are difficult to convert into cash easily.

Usually, this involves money invested in companies, private equity, or even certain types of real estate.

In addition, he says cryptocurrencies could also prove too complex for family members to take control.

Doyle told DailyMail.com: “Digital assets can be challenging to manage and secure if heirs are not well versed in blockchain technology.

“Provide clear instructions on how to access and manage these assets, or consider turning them into more traditional investments.”

And Chad Holmes, of Formula Wealthnotes that some assets can have serious tax consequences.

For example, Roth IRA accounts can be passed down from generation to generation. However, these retirement pots are taxed when they are withdrawn – unlike a traditional 401(K), which is charged upfront.

When a Roth IRA owner is taxed on their withdrawals, they are usually in a lower tax bracket after they retire.

But their adult children are likely to fall into a higher tax bracket, which means they’ll be more severely penalized if they try to withdraw money from the account after their parents die.

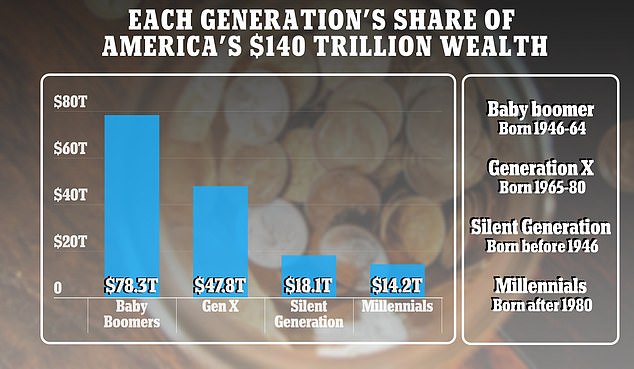

Families are preparing for the so-called “Great Wealth Transfer,” as estimates suggest that baby boomers will pass a record-breaking $53 trillion to their children by 2045. American households are said to own $140 trillion in wealth

Holmes said, “Tax brackets are key to building this proactive inheritance strategy.

If the aging parents are in a lower tax bracket compared to their adult children, it may make sense for the parents to bring forward IRA withdrawals in the coming years.

“By spreading this taxable income over several years, they never get a spike in tax rates.”

Assets disposed of during a person’s lifetime are generally subject to capital gains tax on the appreciation of the asset over time.

The tax payable is largely determined by the difference between the value of the asset at the time of purchase and the value at the time of transfer.

The exception to this rule is that assets, such as property, are passed on to beneficiaries at the time of a person’s death.

The death of the owner gives the recipients what is known as a ‘step-up in basis’ – they inherit the asset as if it had been purchased at its current value and not at the time it was actually purchased.

This, in turn, eliminates all capital gains taxes.

That’s why Holmes recommends waiting until after your death before transferring your home to your children.

He said, ‘Assuming there is profit in your house, never give your house to your child while you are alive.

“The child will have to pay capital gains tax on the property if he or she has not owned AND lived in it for the past five years.

“If they inherit the house after you die, they’ll get that magical step up in the base. Consider assigning the children your house so they can avoid an inheritance.”