The surprising things Aussies are cutting back on to deal with the cost of living crisis

Australians are now turning to illegal loose leaf tobacco to cope with the cost of living and avoid a cigarette tax increase, a professor says.

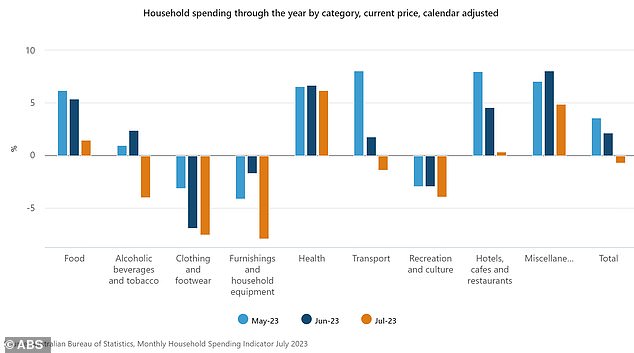

The new Australian Bureau of Statistics, which released data this week, showed spending on alcoholic beverages and tobacco fell by four per cent in the year to July, based on bank transaction data.

This happened even before the excise duty on cigarettes was increased.

This contradicts the orthodox economic theory of inelastic demand, in which expenditure on addictive products remains the same regardless of price increases.

But Mark Wooden, an economics professor at the University of Melbourne who has studied addiction among the long-term homeless, said smokers are more likely to be poor and turn to cheaper substitutes such as loose leaf tobacco, some of which is sold illegally or grown without a permit. .

“You will find that the most inelastic demand will be among the poorest in our community who smoke the most,” he told Daily Mail Australia.

“They find the channels to circumvent these expenses.

“For someone who is a chain smoker and smokes for the last 40 years of his life, it’s very difficult to get rid of it.”

Australians are now turning to illegal loose leaf tobacco to cope with living costs and avoid a cigarette tax hike, a professor says (stock image)

The new Australian Bureau of Statistics, which released data this week, showed spending on alcoholic beverages and tobacco fell by four percent in the year to July, based on bank transaction data (stock image)

With ABS data based on online banking transactions coupled with tap-and-go payments, it is likely that the data did not collect illegal cash transactions for illegal chop chop.

‘Who knows how this is picked up in these data sources? It’s illegal, so I guess it’s not even in there,” Professor Wooden said.

It is illegal to grow or manufacture tobacco products without a permit, with the Australian Revenue Service prohibiting cultivation for personal use.

Spending on liquor and tobacco had increased in previous months, with an annual increase of 1 percent in May and 2.4 percent in the year through June.

“Obviously, we don’t really think of alcohol and tobacco as essential, for the person who’s addicted to it, it’s essential,” Professor Wooden said.

But it appears that consumers already changed their spending on cigarettes before the tobacco tax hike on Sept. 1, when the excise tax per stick weighing less than 0.8 ounces increased to $1.24335, up from $1.16435.

For a pack of 30 cigarettes, that works out to an additional $2.37.

“If you’re a smoker, chances are if the price goes up you’ll get annoyed and then you’ll keep smoking and get poorer,” Professor Wooden said.

“Smoking taxes are extremely regressive, they really harm the poor.

“But of course it’s a socially unacceptable activity, so we don’t care about them as a society, thinking we’re helping them.”

Professor Wooden said higher cigarette taxes are more likely to deter young people than encourage long-term smokers to quit.

“What we’re actually doing with those taxes is maybe preventing newer people from taking advantage of them,” he said.

“The young: they haven’t gotten as addicted, it’s going to be a much bigger burden for them, they have less access to the alternatives, the cheap channels – the homegrown tobacco.”

A Marlboro Red 25-pack is now $60.95 at Coles, while a box of Chesterfield Gold is $287.

Tobacco taxes will be raised by five percent annually for the next three years, on September 1, on top of regular inflation indexing, in an effort to discourage people from adopting the deadly habit linked to lung cancer.

Health Secretary Mark Butler announced in May’s budget the measure to raise $3.3 billion over four years, including $290 million in GST payments going to the states and territories.

However, loose leaf tobacco is not subject to the same excise duties as cigarettes, but the government has indicated that it wants a uniform approach to tobacco taxation.

Australians continue to spend more money on essential necessities, with food spending rising 1.5 percent in the year to July, while health care costs rose 6.2 percent.

Australian Bureau of Statistics data released this week shows spending on alcoholic beverages and tobacco fell by four per cent in the year to July, based on bank transaction data (pictured is a bar in Sydney)

Spending on liquor and tobacco had increased in previous months, with an annual increase of 1 percent in May and 2.4 percent in the year through June

The Reserve Bank of Australia left interest rates unchanged on Tuesday for the third month in a row at the highest level in eleven years, namely 4.1 percent.

But the twelve interest rate hikes since May 2022 have caused monthly mortgage repayments for a variable loan to increase by 63 percent.

The rate hikes are having some effect on inflation: the consumer price index fell to an annual rate of 4.9 percent in July, the lowest level since February 2022, down from June’s 5.4 percent, based on the official monthly measure .

Inflation is still well above the Reserve Bank’s target of 2 to 3 percent, but is well below the December 2022 level of 8.4 percent.