NatWest and HSBC Cut Mortgage Rates Again: Could We See Five-Year Rates Below 5% Soon?

Mortgage deals continue to steadily get cheaper, with HSBC, NatWest and Accord starting the week by announcing a number of interest rate cuts.

Starting tomorrow, HSBC will lower rates on several deals aimed at first-time buyers, home movers and refinancing mortgage holders.

Notably, HSBC’s cheapest five-year plan, for homebuyers with at least a 40 percent down payment, will drop from 5.25 percent to 5.16 percent. The deal includes a £999 fee.

Meanwhile, those who take out a new mortgage with HSBC with at least 40 percent of their home equity can secure a five-year interest rate fix of 5.34 percent, compared to 5.44 percent. Again, a fee of £999 applies.

Happy Monday: Mortgage deals continue to steadily get cheaper, with HSBC, NatWest and Accord Mortgages starting the week announcing a number of rate cuts

Similarly, NatWest will reduce some of its rates for home movers, first-time buyers and those taking out a new mortgage, even though the majority of its products see little improvement.

For example, the cheapest five-year solution for those buying with at least a 40 percent down payment remains 5.27 percent.

Together with HSBC and NatWest, lender, Accord Mortgages is also cutting its fixed interest rates by 0.2 basis points starting tomorrow.

Nicholas Mendes, mortgage technical manager at broker John Charcol, believes that lenders compete with each other to win business and that this helps lower interest rates.

“What a start to the week: HSBC, Accord and now NatWest in the final attempt to battle for first place,” said Mendes.

With the new rates starting tomorrow, it will be interesting to see if any of the current lenders make another change before the end of the week to stay ahead.

“We’ve seen lenders across the market improving their criteria to win more customers.

“Large lenders in particular have repriced their products in rapid succession when they see competitors make changes.”

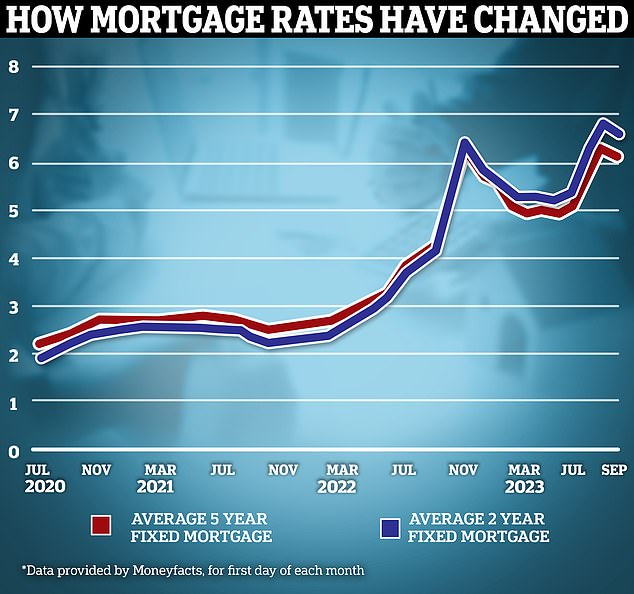

According to Moneyfacts, five-year fixed interest rates averaged 6.19 percent on Sept. 4. The average two-year fixed interest rate was 6.7 percent.

That’s less than a peak of 6.86 percent for two-year fixes in late July and 6.37 percent for five-year fixes.

Past the peak? Fixed mortgage rates seem to be falling somewhat after a deluge of rate hikes in recent months

While rates have fallen somewhat in recent weeks, they continue to rise from 5.17 percent and 5.49 percent on June 1. And a lot higher than two years ago, when the average interest rate over two years was 2.52 percent and the average interest rate over five years was 2.75 percent.

But mortgage holders should expect the downward trend to continue, said Nicholas Mendes of mortgage broker John Charcol.

He says: “The five-year fixed rate will continue to fall as future market expectations improve with each announcement of downward inflation.

“We have seen five-year fixed rates fall steadily over the past few weeks, with this pattern continuing through the end of the year.

“Anything starting at 4 percent will be good news, with hopes of a low 4 percent by the end of the year.”

Similarly, Mendes expects the two-year fixed rate to fall, even as he expects borrowers to pay more than 5 percent through the end of the year.

“Expect the majority of the two-year fixed rate to be at 5 percent,” Mendes adds. “Hopefully we will see the 5 percent limit being broken, but at the moment we don’t see that happening yet.”

For anyone facing the dreaded re-mortgage, Mendes suggests planning ahead.

‘Talk to a mortgage advisor at least seven months before your fixed rate ends.

“The market rates are higher than if you probably would have set them in the past, so you want to make sure you understand how this could affect your budget.

“You can make a new deal six months before your rate expires, which means if interest rates go up, you’ve got a favorable deal.”

“Even if interest rates fall, you can always move to the better rate, whether it transfers to the new lender’s lower rate, whether you choose to re-file with a new lender, or stay with your existing lender once you know their rate, usually three months before your fixed rate ends.’

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.