TEMPLE BAR TRUST Household names are starting to pay off for the patient duo

TEMPLE BAR TRUST Household names are starting to pay off for the patient duo

Patience is the key ingredient behind the recent success of publicly traded investment fund Temple Bar. Since Ian Lance and Nick Purves of investment firm Redwheel were brought in at the end of 2020 to manage the £677m fund and review the portfolio, they have not left any shares.

Everything they bought back then they kept, although they occasionally increased positions – and took profits. Only two new interests have been acquired: one undisclosed (the position is being built up) and the other in the Dutch car finance and insurance company Stellantis.

“It’s a waiting game,” says Lance. “We sit there, let our interests run and we set aside the dividends for our shareholders as they come in. It may sound boring from an investment point of view, but in terms of generating returns it can be quite exciting.”

The shareholder return results were certainly exciting. Since the veteran managers took full control of the trust at the end of October 2020, investors have achieved a total return of 81 percent.

This is double what the average UK equity income fund and the FTSE All-Share Index have returned over the same period. Lance admits there was a bit of luck involved when it came to the timing of their appointment. “We were reviewing the portfolio while the country was in lockdown and many UK stocks were in serious trouble,” he says.

“It fit our modus operandi, which is to buy shares when the price is low and hopefully sell them at a much higher price over a longer period of time. We don’t really get into stock trading until the markets are disrupted, like in 2020 – and even further back, during the 2008 financial crisis.”

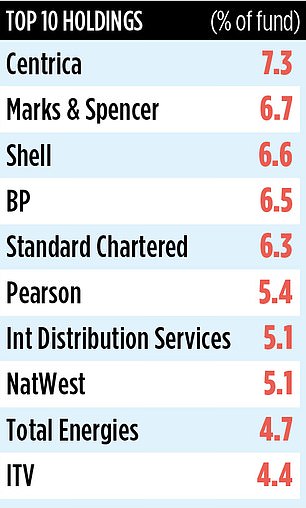

The trust now consists of just 25 holding companies, most of which are UK-listed. They are all household names – such as energy giants BP and Shell; banks NatWest and Standard Chartered; and retailer Marks & Spencer.

“Marks & Spencer is right around the corner,” says Lance. It is back as a constituent of the FTSE 100 Index and will soon return to paying dividends after suspending them when the pandemic hit in 2020. It’s a retail success story.”

Shares in M&S are now trading around £2.30 compared to 92p in November last year.

Dividends are an important part of Temple Bar’s appeal to investors. After getting a haircut in 2020, they recovered in 2021 and 2022. So far, the trust has announced two quarterly payments this year, which together exceed what was paid last year.

While Lance says the UK stock market is cheap compared to other markets, he is not confident international investors will return in numbers. He adds: ‘There are some great companies here that are doing well, but the market doesn’t value them. We tell some companies with strong balance sheets to buy back shares to boost their share prices and earnings per share.”

Lance says fund manager Neil Woodford made a name for himself as an astute investor in the early 2000s (before later losing the plot) by buying dividend-friendly tobacco stocks that bought back stocks.

Temple Bar shares currently offer an annual income of just over four percent. The market identifier is BMV92D6 and market ticker TMPL. The annual costs total 0.54 percent.

One last note. Temple Bar split its shares in May last year. It means that investors now hold five shares for every share they previously owned — which, in monetary terms, explains why the dividend per share is about a fifth of what it used to be.