Gold Coast house prices are booming as Aussies flee population boom in Sydney and Melbourne

House prices on the Gold Coast are rising as Aussies flee the larger capitals in search of a warmer climate and to escape traffic congestion.

An influx of overseas immigrants to Sydney and Melbourne coincides with a rush to south-east Queensland.

Brisbane was Australia’s best performing capital city market in August. Median home prices rose 1.6 percent last month, and 4.3 percent over three months to $832,247, CoreLogic data showed.

The Gold Coast, an hour’s drive from Brisbane, fared even better, with Palm Beach’s median home price rising 8.6 percent during the quarter to $1,623,836.

In nearby Currumbin Waters, house prices rose 6.7 percent in three months to $1,555,746, while in Bundall, a canal district next to Surfers Paradise, they rose 8.2 percent to $1,794,891.

CoreLogic research director Tim Lawless said Australians were still flocking to the Gold Coast from other parts of the country.

“High internal migration to these areas is likely to be a key factor supporting housing demand and housing values in these areas,” he said.

House prices are rising on the Gold Coast, even as property values are falling across much of regional Australia (photo shows swimmers at Surfers Paradise)

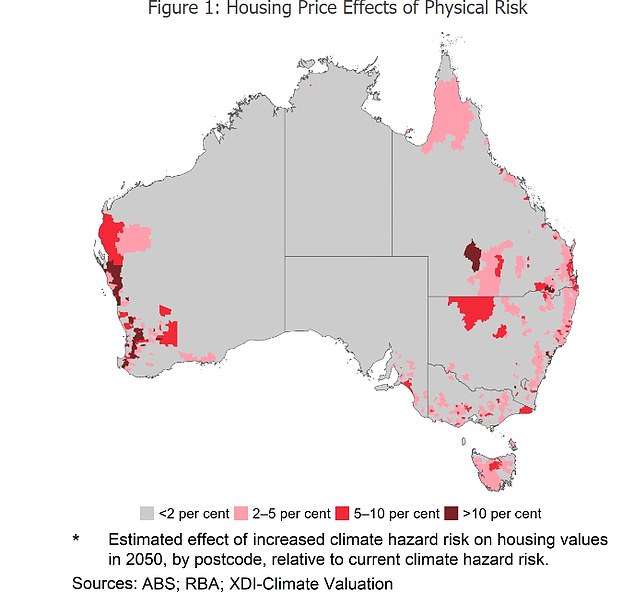

The rising house price numbers come after Michele Bullock, the new governor of the Reserve Bank, gave a speech warning that areas of the Gold Coast are likely to see a five to ten percent drop in property prices by 2050 as a result. of climate change.

She gave a speech in Canberra on Tuesday night with a slide showing a map of Australia with red dots over areas at greater risk of flooding or cyclones.

The Gold Coast was colored tomato red, indicating a bigger fall in house prices, while most of the coast of New South Wales was colored pink, predicting a two to five percent drop in property prices.

House prices in these areas of the north coast of NSW are declining, despite professionals being able to work from home.

House prices in Byron Bay are down 4.8 percent over the past three months to $2,398,235, while in West Ballina they are down 6.7 percent to $885,283.

Regional markets took longer to recover from the Reserve Bank’s 12 rate hikes since May 2022 as foreign immigration hit record levels.

“With internal migration trends normalizing in regional Australia and less demand pressure from net overseas migration than in the capitals, regional markets are generally not seeing the same level of recovery,” said Lawless.

Before the 2020 Covid pandemic, regional areas housed only 15 percent of overseas migrants.

Sydney generally receives a higher share of permanent and long-term overseas migrants, with the city’s average house price rising 1.1 percent in August to $1,359,936, and 4.1 percent in three months.

“Sydney has been at the forefront of the recovery trend so far,” Lawless said.

The most aggressive pace of monetary policy tightening by the Reserve Bank since 1989 had hit Sydney more than any other market because it is by far the most expensive market.

The Gold Coast is booming and Palm Beach’s median home price is up 8.6 percent during the quarter to $1,623,836 (photo shows a luxury home for sale)

The Reserve Bank is not particularly impressed with incoming governor Michele Bullock who delivered a speech this week warning that parts of the Gold Coast are likely to experience a five to ten percent fall in property prices by 2050 due to the climate change.

This caused prices to fall 13.8 percent from the peak in early 2022 to early 2023, but an influx of skilled migrants and international students has supported a recovery.

A record 353,670 migrants moved to Australia between 2022-2023, the highest number in a financial year. Since the trough in January, property prices in Sydney have risen 8.8 percent – for the seven consecutive months.

Inner-city areas outperformed the rest of the city, with home prices in Surry Hills rising 8.1 percent in three months to $2,219,334.

Before the surge in overseas migration, Brisbane saw its population grow by 2.3 percent to 2,628,083 in fiscal year 2021-2022, with new residents moving in from other parts of the country, data from the Australian Bureau of Human Resources has shown. Statistics.

By comparison, Sydney’s population grew by just 0.7 percent to 5,297,089, with official data covering the months before Australia reopened to migrants in December 2021.

Now that Australia has reopened, property investors are particularly drawn to Queensland, where new loans rose 6.8 percent in July to $1.9 billion, making it the only state to see a sustained increase since February.