CITY WHISPERS: Will MGM still be willing to gamble on Entain?

>

CITY WHISPERS: Will MGM still be willing to gamble on Ladbrokes owner Entain?

Shareholders of Ladbrokes owner Entain must have struggled to read the runes last week.

First, there were rumors, reported in The Mail on Sunday, that joint venture partner MGM Resorts is considering a bid.

That was followed by the good news on Thursday that the joint venture in question, BetMGM, had a thriving 2022 with net income up 69 percent to $1.4bn (£1.1bn), ahead of expectations.

Confusion: Shareholders of Ladbrokes owner Entain must have struggled to read the runes

So far so good. Entain will provide an update on its own trading this week. But it is said any bid from MGM is contingent on a government white paper on gambling due next month.

Also on Thursday, Gambling Secretary Paul Scully told the Betting and Gaming Council that there are still too many shortcomings and that the bill could be more draconian than they had hoped.

Investment bank Jefferies took note of the “negative tone,” adding that further talks seem likely “adding uncertainty.”

Will that dampen MGM’s enthusiasm?

Political attitude towards British battery industry positive

While the future of collapsed electric battery maker Britishvolt hangs in the balance, another company is quietly making progress.

The government had refused to release money to support Britishvolt.

However, the political attitude towards building a UK battery industry is still positive, according to a report from Liberum last week.

Ilika, who is on the AIM list, has won a place in the £330 million state-backed Faraday Battery Challenge, which aims to get electrical technology off the ground.

Turbulent time at Direct Line

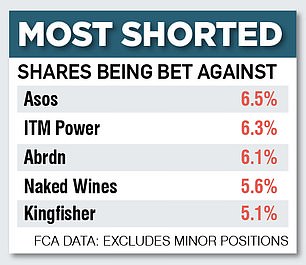

A turbulent time at Direct Line has not gone unnoticed. After cutting dividends and issuing a profit warning this month, short positions in the insurer hit a 10-year high last week.

Share price of the FTSE 250 company has fallen 43 percent over the past year, leading to the departure of CEO Penny James last week.

Figures from the Financial Conduct Authority show that the number of contracts lent for Direct Line is almost 3.5 percent.

Short sellers will be celebrating this weekend as the company’s value fell to £1.75 on Friday, its lowest low in five years.

Contango confrontation

In the latest round of AVA revolts, coking coal mine Contango Holdings could face off with investors next week over governance concerns.

Trustees ISS and Glass Lewis have urged shareholders to abstain or vote against re-election of directors at next week’s annual meeting.

ISS cites, among several bugbears, that the two non-executive board members have too many stock options to be considered independent.

Glass Lewis resents the re-election of non-executive chairman Roy Pitchford because the company has no compensation or audit committees.

Setting up these groups can be tricky with just three board members, but it’s still city best practice.