JEFF PRESTRIDGE: Life insurance advert is just plain repulsive

>

Convincing people to buy life insurance is not easy. When we are young, we believe that we are invincible and needless. Only when we buy a family home and take out a mortgage is it seriously considered – and even then many shun it.

This may explain why some companies use shock tactics to get people to consider coverage, which pays out a tax-free lump sum in the event of death. In isolated cases, the tactics are nauseating rather than shocking.

The latest ad from DeadHappy, an online life insurance retailer endorsed by the Cheshire-based Shepherds Friendly Society, is as unsavory as it gets.

Sick: The DeadHappy Facebook ad featuring Harold Shipman

It appears on Facebook and features a photo of serial killer Dr. Harold Shipman with an accompanying tagline that reads, “Life insurance. Because you never know who your doctor is.’

For those who forgot Shipman – or missed the 2002 ITV drama Harold Shipman: Doctor Death, starring James Bolam – he was convicted in January 2000 of the murder of 15 elderly patients he cared for. He is also suspected of being responsible for another 250 deaths. He committed suicide in 2004 while serving a life sentence at Wakefield Prison in Yorkshire.

DeadHappy likes to push the boundaries. The tagline is ‘life insurance to die for’, while previous ads featured a picture of a pigeon pooping next to the words: ‘We think life insurance is s#*! So we redesigned it.’

But the Shipman ad goes a step too far. Certainly, financial protection advisers think so.

They attacked DeadHappy through online financial publication FTAdviser – stating that the ad is disrespectful to the families of those killed by Shipman. A victim’s family member took to social media to tell DeadHappy, “Your latest ad using his image is despicable and unacceptable.” The ad is also defamatory of the medical profession.

Shepherds Friendly Society is not impressed either. It told me, “We expressed our view to DeadHappy that the ad circulated on social media featuring Harold Shipman was distasteful and inappropriate.

“We are committed to our values and this is not in line with them. We have asked DeadHappy to remove the ad immediately and are currently investigating further.” On Wednesday, I asked Alan Knott, founder of DeadHappy, if the ad would be withdrawn — he avoided the question.

But he did say, “We are aware of the provocative (and to some deeply shocking) nature of our brand. But being provocative is different from being offensive and it is of course never our intention to offend or upset people.

‘It is our intention to make people think.’

On Friday, Knott softened his stance and admitted that the Shipman ad was flawed. He said, ‘We made a mistake. We are now leaving and immediately reviewing all of our current and future marketing campaigns.”

Some people have already reported the ad to the Advertising Standards Authority (ASA), an organization that DeadHappy knows quite well. In 2019, it banned its ad of a man leaning his head against a wall with the tagline (again): “Life insurance to die for.”

The ASA concluded that the ad downplayed suicide.

If you would like to make a complaint about the Shipman advertisement, please contact asa.org.uk/make-a-complaint.

The charities that deserve a resounding endorsement

On the strings: Whistleblower Tim Lowe says charities need more financial support

The bell ringers of St Thomas’ Church in Mellor, Lancashire, are a lively bunch. Over the years they have raised a lot of money for charities – big ones like Cancer Research UK and Prostate Cancer UK – as well as local charities like St Ann’s Hospice in Cheadle.

In seven days, the five-member team of campanologists will celebrate the feast of St. Agatha (patron saint of bell-founders and breast cancer patients) by encouraging locals to climb to the belfry and ring Old Paddy, a three-quarter ton bell.

For a small or large donation, locals also get a taste of whistleblower’s soup, including a drop of whisky.

Those who feel like whistleblowing can go from 11.30 am. Tim Lowe, part of the whistleblowing team, initially contacted me about the rising cost of his home coverage, but was also eager to talk about the fact that many cancer charities are in dire need of financial support.

So if you can’t reach Mellor, consider donating directly to the charities – just mention ‘Festivals of Bells’ – and if you’re a taxpayer, don’t forget to top up your donation with Gift Aid.

Tim says they have great calling plans for Coronation Day (May 6). He also persuaded me to visit them at some point and call them.

That’s another item that’s almost been checked off my bucket list.

NS&I listens and increases its rate AGAIN

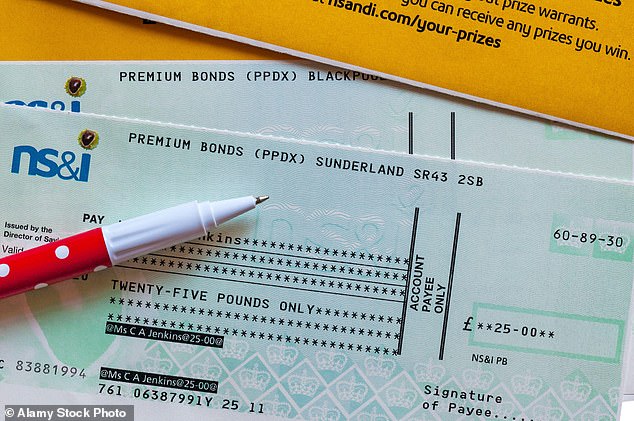

First the good news. Government-backed savings giant NS&I has (again) listened to readers of this column – and has increased the price percentage on Premium Bonds for the second time in as many months.

The bad news? Well, the raise isn’t as generous as it should be.

The effective annual rate rises from three to 3.15 percent next month — below the 3.5 percent we collectively called for.

Boost: government-backed savings giant NS&I has (again) listened to the readers of this column

But as my dear mother Helen would say if I got a second hand Action Man for Christmas – instead of a brand new one – beggars can’t choose.

The higher prize rate will be in situ when the February draw takes place on a Wednesday.

It means more winners in all prize categories except £1m (two winners per month) and £25. Although the Bank’s base rate should rise from 3.5 per cent to 4 per cent a day later – causing some best-buy savings accounts become relatively more attractive – I would stick with your Premium Bonds.

They provide a little fun in a world where fun is scarce.

As NS&I chief executive Ian Ackerley said a few days ago, the prize rate is at its highest level in more than 14 years, when it was 3.4 percent between May and November 2008.

For those with Premium Bonds in their portfolios, good luck for Wednesday. I trust you will get a message from NS&I saying you are a winner (I keep my fingers crossed).

Bumper profit

Last week I invited readers to let me know if they had ever won more than nine Premium Bond awards in one month. This followed a challenge from Norwich’s Paul Parsons, who revealed that he and wife Patricia had once won nine awards together.

A number of you came forward (thanks) to say you had trumped the Parsons, but the ‘winners’ were Neil and Helen Hyde, from Worthing in West Sussex.

Neil, a 50-year-old estate agent, and Helen, a part-time school assistant, won 13 awards last September, totaling £425.

Conversely, Jenny Norman, from near Ipswich in Suffolk, hasn’t won a dime in three months – despite having the maximum stake of £50,000.

Husband Ray, a 75-year-old antiques dealer, has promised to let me know on Wednesday if Jenny’s fortunes change for the better.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and use it for free. We do not write articles to promote products. We do not allow any commercial relationship to compromise our editorial independence.