Got a nest egg of less than £30k? You can invest it for £60 a year

>

Investment platform Interactive Investor is launching a new product this week, designed to entice savers with tiny nest eggs. Investor Essentials, available from Wednesday, allows clients with up to £30,000 to invest for a flat fee of £4.99 per month.

Until now, Interactive Investor customers on the most popular plan have been charged £9.99, regardless of how much they invested. The model implied that Interactive Investor’s pricing was competitive for those with big pots, but not for those with less to invest.

The new offer gives those with smaller pots access to the same range of investments as those with larger amounts, but at half the price.

Nestei: Clients with up to £30,000 can invest for a flat fee of £4.99 per month

Jeremy Fawcett, founder of financial advisory firm Platform, says: ‘Interactive Investor has always been one of the more expensive options for those starting out in investing, but one of the most competitive options for those more advanced.

“This product is the missing first rung on the investment ladder.”

Once a customer starts to hit the £30,000 threshold, they’re automatically switched to the £9.99 per month plan. Existing customers with investments under £30,000 will need to request to switch to the Investor Essentials plan if they wish to do so.

Interactive Investor CEO Richard Wilson says, “Historically, a percentage-based fee structure has generally been cheaper for people at the beginning of their investment journey.

“Providers then hope their customers stay with them without ever calculating the cost savings they could make in the long run as their investment grows.

“Investor Essentials, with its low monthly fees, changes everything and brings greater value and choice to a much wider audience.”

Like investors with the standard Investor Plan, Investor Essentials allows investors to invest regularly in funds, mutual funds and popular UK stocks for free. They also pay the same fee of £5.99 for each transaction of UK and US stocks, funds and trusts.

However, unlike the Investor Plan, they do not get a free monthly transaction or free access to a Junior Isa.

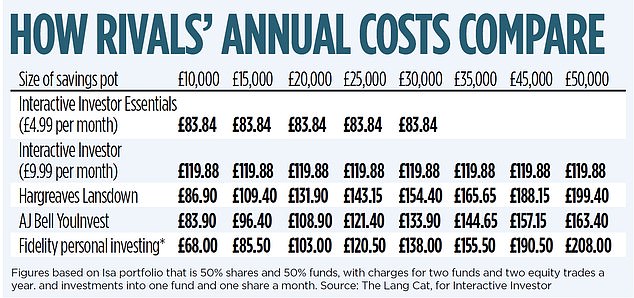

The new pricing means that Interactive Investor is now cheaper for savers by between £15,000 and £30,000 than its rivals Hargreaves Lansdown, AJ Bell YouInvest and Fidelity, according to calculations carried out for the platform by consultancy The Lang Cat (see table).

Fidelity is still cheaper for savers at £10,000 even after the price hikes next month.

However, Holly Mackay, from investment website BoringMoney, points out that there are a number of newer platforms and products aimed at new investors. While not all of them offer a full range of funds, mutual funds, and stocks, many of them offer very competitive rates. “For this target market, I would say the main competitors are Dodl (an app-based platform by AJ Bell), Freetrade and Moneybox,” she says.

‘Dodl has a limited range of funds and shares, but costs 0.15 per cent per annum – that’s £15 on a £10,000 investment. Freetrade costs £4.99 per month for an Isa, which is £60 per year on a £10,000 investment. And Moneybox is £1 a month plus 0.45 per cent a year – that’s £57 a year on a £10,000 investment and contains a very limited range, but a super simple app.’

Millions of Britons began investing their savings for the first time during the pandemic and the following months. Many found themselves with more time and money to spare during the lockdowns and were tempted by the strong financial markets.

Most have continued to invest and form a cohort that is hard to ignore. Last April, AJ Bell launched Dodl to entice these newer investors, and Interactive Investor’s move is trying to attract them as well.

Once investors have joined an investment platform, they rarely shop around and change. Therefore, if a platform can entice a new investor, chances are they will stick with it for decades to come.

But while the number of new investors is growing, there are still millions of people who leave large sums in savings accounts instead of investing.

In the long run, savers can make more money by investing their money than by leaving it to earn interest in a savings account.

The Financial Conduct Authority’s mission is to reduce the number of consumers who could benefit from investment returns, but miss out. The financial watchdog has set a goal to reduce this number by 20 percent between 2021 and 2025.

Platforum’s Fawcett added: “Small pot investors are currently a particular focus for the FCA. It makes no sense to have large sums of investable capital in a savings account, especially in a time of high inflation.

“This step by Interactive Investor will help to better serve this group.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and use it for free. We do not write articles to promote products. We do not allow any commercial relationship to compromise our editorial independence.