Most Americans OPPOSE raising the debt ceiling without spending cuts

>

Most Americans would rather see a government shutdown than see the federal government raise its borrowing limits without cutting spending, according to a new poll.

Fifty-six percent of Americans would prefer to see a partial government shutdown until Congress can agree to cut spending or keep it the same, while 34 percent would prefer to avoid partial spending by raising the cap without negotiating spending.

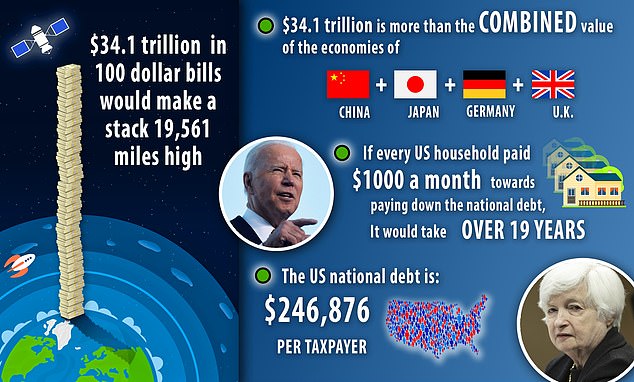

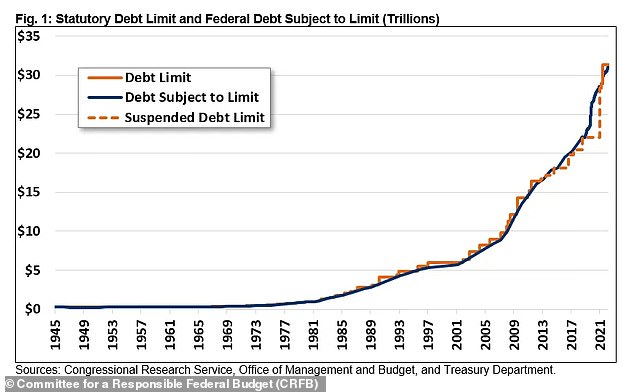

President Biden and House Republicans are at loggerheads after the US hit its $31.4 trillion borrowing limit last week, prompting the Treasury Department to take “extraordinary steps” to prevent a debt default that could unleash economic chaos.

The extraordinary measures will buy the Treasury through June on the possibility of a default, according to Sec. Janet Yellen.

But with the Biden White House saying it won’t negotiate on spending cuts and House Republicans saying they won’t agree to raising the cap without them, the political stalemate may well go until the June deadline.

Experts say a US default would not only mean the US government couldn’t pay its workers, but defaulting on debt could have repercussions around the world and trigger a global recession.

President Joe Biden says he won’t negotiate to allow the government to default on its bills

Republicans, who see an opportunity to control spending, have not ruled out cuts in the government’s most expensive programs, such as Social Security and Medicare.

Four years ago, when Donald Trump was president and clashed with Democrats over the debt ceiling, 54 percent of those polled said they preferred a partial shutdown.

Most Republicans (71 percent) and independent voters (56 percent) would prefer a partial government shutdown until Congress agrees to cut spending or stay the same, and 41 percent of Democrats agree. with them.

Fifty percent of Democrats would prefer to avoid a partial shutdown, even if it means authorizing more spending, while just 22 percent of Republicans and 30 percent of independents feel the same.

In particular, respondents who earn between $30,000 and $50,000 per year are more likely to say they would prefer a closure to more spending.

Sixty-six percent of those surveyed said the increase in the size of the federal budget was due more to politicians’ unwillingness to cut public spending, while 21 percent said it was due to unwillingness taxpayers to pay more taxes.

The United States hit a ceiling on Thursday, forcing the Treasury Department to start using “extraordinary measures” so the government can keep paying the bills as Congress negotiates to try to avoid an economic collapse that would otherwise come in June.

The federal debt ceiling was raised in December 2021 by $2.5 trillion to $31.381 trillion, which is expected to be reached on Thursday, January 18.

A related RMG Research survey first obtained by daily signal found that 45 percent of Americans believe Congress should raise the debt ceiling with spending cuts, 16 percent think they should not raise it at all, and 24 percent think Congress should raise the debt ceiling. debt without spending cuts.

RMG Research then posed the same question again to voters with additional background:

Treasury Department officials and other economic experts say refusing to raise the debt ceiling would force the government into default and severely damage the economy. Knowing this, how should Congress address this problem?’

Still, 48 percent of Americans said Congress should raise the debt ceiling with spending cuts and 14 percent said it should not raise it at all.

The US dollar cemented itself as the world’s reserve currency based on the global faith that the United States pays its debts. Banks, financial firms, and entire nations use the US dollar and Treasury bonds to back their assets and conduct international transactions. If they lose that confidence in the dollar, it could bring down the global financial system.

Still, House Speaker Kevin McCarthy put it this way: ‘If you gave your kid a credit card and he kept hitting the limit, he wouldn’t keep raising it.

‘You would sit down with them to identify where they are overspending and where they can change their behaviour. It is time for the federal government to do the same.’

The White House went on the attack this week.

Press secretary Karine Jean-Pierre said Wednesday: “They are threatening to eliminate millions of jobs and 401K plans by trying to hold the debt limit hostage unless they can cut Social Security, cut Medicare, cut Medicaid ”.

Treasury data showed that Social Security tops a list of costly government programs at $1.2 trillion per year. Medicare posted fifth place with $750 billion.

Both programs are currently on track to become insolvent in the next few years, with Medicare about six years from bankruptcy and Social Security 12 years from insolvency.

McCarthy will sit down with Biden for his first face-to-face interview with the president since he became a speaker, but Biden has insisted he won’t haggle over spending cuts in exchange for raising the debt limit.

Even Sen. Joe Manchin, DW.Va., wants Biden to negotiate, telling CNN it would be a “mistake” if the president didn’t talk about spending cuts, particularly focused on rooting out waste, fraud and abuse.

Senator Dick Durbin told CNN that Biden should “absolutely not” negotiate with House Republicans. “We shouldn’t gamble with the national debt,” he said.

The United States has never defaulted on its debt in history. In 2011 there was a showdown between President Obama and the Republicans, which rocked the markets and reportedly cost the government $1 billion. Obama finally struck a deal with the GOP that capped spending for a decade, and today’s Republicans hope to sign a similar deal.

Biden, for his part, has emphasized the Republicans’ involvement in the debt increase in the first place. He noted in remarks at the White House on Friday that roughly a quarter of US debt in the last 200 years was incurred during “the four years of my predecessor,” referring to the Trump administration.