Finance pro Queenie Tan reveals exactly how she manages her payday routine

>

A young financial professional shared exactly how she manages her money when she gets paid and how she keeps track of her finances to reach new savings goals.

Former marketing manager Queenie Tan, 26, from Sydney, started researching and investing when she was 19 and now has a diverse financial portfolio and a net worth of more than $500,000.

in a new instagram videoQueenie said she has a ‘regular payday routine’ where she pays herself a monthly salary.

scroll down for video

A young financial professional with a net worth of over $500,000 shared exactly how she manages her money when she gets paid and how she tracks her finances to reach new savings goals (Queenie Tan pictured)

Former marketing manager Queenie Tan (pictured), 26, from Sydney, started researching and investing when she was 19 and now has a diverse portfolio and a net worth of more than $500,000.

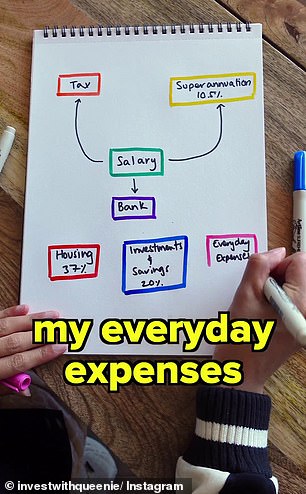

“Before my monthly salary hits my bank account, I pay taxes and 10.5 percent of my salary goes into my retirement, which is my retirement savings,” Queenie said.

‘So, I have my expenses.’

The 26-year-old defined her expenses as her housing, which makes up 37 percent of her income, her savings and investments, which make up 20 percent of her income each month, and then her daily expenses like bills, food. , transportation and entertainment.

These everyday expenses take up the remaining 43 percent of your income.

The 26-year-old defined her expenses as her housing, which makes up 37 percent of her income, her savings and investments, which make up 20 percent of her income each month, and then her daily expenses like bills, food. , transportation and entertainment

“I like to use credit cards for my everyday expenses so I can earn points,” Queenie said.

However, he added the caveat that he always reviews his statements regularly and pays off his invoices in full each and every month.

“This is so you don’t pay any interest and can maintain a good credit score,” he said.

Queenie checks your credit score and other financial details through the WeMoney Appwhich is a smart money app that helps people stay on top of their debts.

“I like to keep track of my finances and upcoming bills because all my accounts are listed in one place,” Queenie said.

She said it’s also easy to set goals with the app because you can see your progress, adding that her own goal is “to save for a property where she can raise a family.”

Queenie (pictured) said she always reviews her statements regularly and pays off her bills in full each month.

Financial advisors typically advise people to follow some iteration of the 50/30/20 budgeting rule.

This rule states that 50 percent of your after-tax income must be spent on necessities and obligations you must meet, such as rent and utilities.

The remaining half should be split between 20 percent for savings and debt repayment and 30 percent for your needs and entertainment.

Earlier, Queenie shared the seven sources of income she has to get her closer to becoming a millionaire.

Queenie has multiple stocks and EFTs or Exchange Trade Funds in her portfolio that pay her dividends and make up 10 percent of her total income.

The investor has a popular YouTube channel with more than 55,100 subscribers, and every time an ad is played on one of her videos, she earns 55% of the revenue.

Queenie shared that she has an estimated income for the next six months of more than $12,000 and the payments represent 15 percent of her income.

Another 15 percent of the money Queenie said she receives comes from referrals: “I have partnerships where I get a bonus if someone signs up and they can get a bonus too.”

Half of Queenie’s income comes from brand collaborations on her popular social media channels.

Brands pay the influencer to create content and promote them in the form of paid partnerships.

The former marketing manager sometimes shares her savvy financial knowledge by speaking at events where she gets paid to attend.

He also makes money by renting out his two-bedroom apartment and selling digital products he developed, like his income tracking program.

“I didn’t build these streams of income overnight, they all required patience, hard work and a bit of luck,” Queenie added.

“But I think it’s important to create different streams of income so you don’t have to rely on just one.”

To follow Queenie Tan on Instagram, click here.