Social Security funds could run out as soon as 2033 according to new projections

>

Updated predictions for three of the largest Social Security funds cast a bleak shadow over the future of the American population.

According to the latest projections of the Congressional Budget Officetwo of the funds will be depleted by 2033, while another major fund will be gone by 2048.

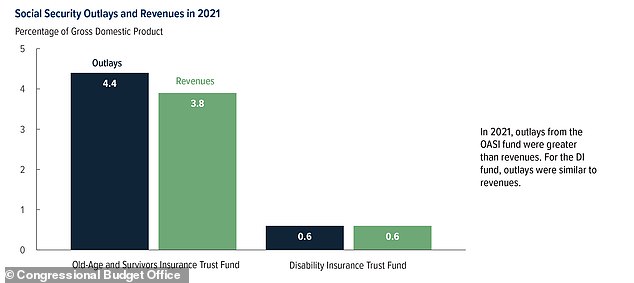

The Old Age and Survivors Insurance Trust Fund are the two funds most in danger of being depleted, while the CBO says the Disability Insurance Trust Fund is also of great concern.

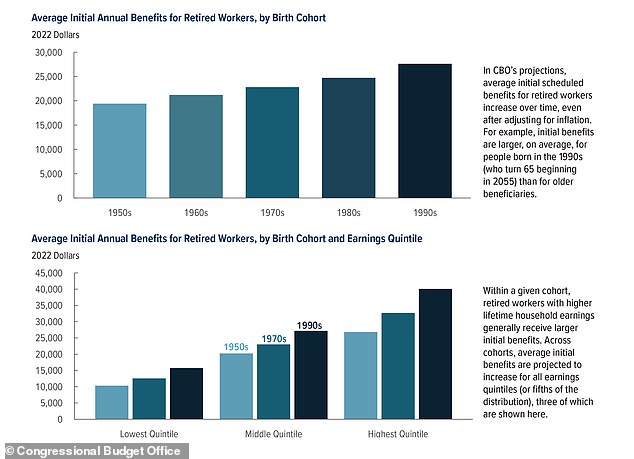

Social Security spending has been on the rise as more Americans reach retirement age and leave the workforce, relying solely on benefits from the fund.

Updated predictions for three major Social Security funds cast a bleak shadow over the future of the US population.

According to the latest projections from the Congressional Budget Office, two of the funds will run out by 2033, while another major fund will disappear by 2048.

News of the projections comes as Social Security recipients saw a big increase in their payments starting in the new year.

Social Security increased benefits by 8.7 percent starting in January to combat record inflation. The increase marks the highest cost of living increase since 1981.

The CBO’s latest projections found that the current gap between fund disbursements and income received, if it continues for the next ten years, will bring the fund officially to zero.

If that happened, the Social Security Administration would not be able to pay full retirement benefits to retirees as they become eligible.

Even if the Disability Insurance Trust Fund and the Old Age and Survivors Insurance Trust Fund were combined, the fund would still be depleted by 2033.

The funds have also been stressed as they have been used to pay payroll tax revenue to retirees.

The Old Age and Survivors Insurance Trust Fund are the two funds most in danger of being depleted, while the CBO says the Disability Insurance Trust Fund is also of great concern.

News of the projections comes as Social Security recipients saw a big increase in their payments starting in the new year.

Social Security spending has been on the rise as more Americans reach retirement age and leave the workforce, relying solely on benefits from the fund.

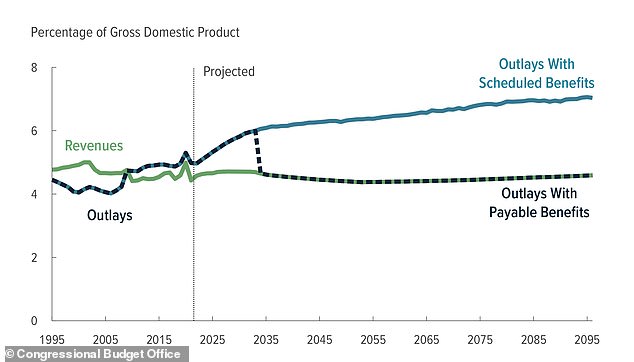

The CBO also predicts that the fund will continue to spend five percent of US GDP. The fund will eventually increase to seven percent by 2096.

The actuarial deficit is projected to rise to 1.7 percent of GDP or 4.9 percent of taxable payroll over the next 75 years.

The forecast means that the balance in the funds could be maintained if there were an immediate increase of almost 5 percent in payroll taxes.

Social Security funds could also be maintained if there were a reduction in overall benefits for retirees.

If only what is available from tax revenue were to be examined, the payments would be about 23 percent smaller than scheduled for 2024.

However, US law could stand in the way of reduced Social Security benefits if it were proposed as an official solution.

As of now, there is no law on the books to reduce benefits to what is available based on payroll taxes.

The CBO also predicts that the fund will continue to spend five percent of US GDP. The fund will eventually increase to seven percent by 2096.

The CBO’s latest projections found that the current gap between fund disbursements and income received, if it continues for the next ten years, will bring the fund officially to zero.

The actuarial deficit is projected to rise to 1.7% of GDP or 4.9% of taxable payroll over the next 75 years

This comes as lawmakers are currently wrangling over how to address the debt ceiling, with some calling for cuts in Medicare and Social Security.

The United States officially hit the debt limit on Thursday, and the Republican Party is working on solutions on how to raise it before a possible default in June.

Last week, former President Donald Trump made headlines for warning his fellow Republicans not to “destroy” retirement benefits.

“Under no circumstances should Republicans vote to cut a single penny from Medicare or Social Security to help pay for Joe Biden’s reckless spending spree, which is more reckless than anyone has ever done or had in the history of our country. ”Trump said in a video. message posted on social media.

‘Don’t reduce the benefits our seniors worked and paid for their entire lives. Save Social Security. Don’t destroy it! Trump continued.

According to the CBO, Social Security represented 17 percent of federal spending in 2021.

Donald Trump issued a warning to House Republicans, led by Kevin McCarthy (right), not to go after entitlement programs as they seek to force savings in the fight for the debt ceiling.

Trump called out Biden’s agenda and called the president’s spending “out of control.”

“While stopping Biden’s rampant spending is absolutely necessary, the pain should be borne by Washington bureaucrats, not hard-working American families and American seniors,” Trump said.

Former president says cuts must be made against ‘corrupt foreign countries’ and ‘climate extremism’, as well as ‘left-wing gender programs of our army.

“Seniors are being absolutely destroyed in the last two years,” Trump said.

A 2020 AARP survey of nearly 1,500 adults found that 96 percent said Social Security was the most important or important government program compared to other government programs.