Recession warning for Australia with big banks all predicting February interest rate rise

>

Australia could plunge into recession if the Reserve Bank raises interest rates even one more time, an economist warns.

The Big Four banks are expecting an interest rate hike on February 7 that would take the cash rate to a new 10-year high of 3.35 percent, marking the ninth straight rise.

Economist Stephen Smith, a partner at Deloitte Access Economics, said even one more rate hike in 2023 could send Australia into a recession.

Australia could plunge into recession if the Reserve Bank raises interest rates even one more time, warned one economist, Stephen Smith, a partner at Deloitte Access Economics (a 2022 Melbourne auction pictured).

“In our view, any further increase in the cash rate beyond the current 3.1 per cent could unnecessarily push Australia into recession in 2023,” Smith said.

“By the Reserve Bank’s own estimates, mortgage repayments, including principal and interest, are already on track to reach a record level as a percentage of household disposable income in the coming months.”

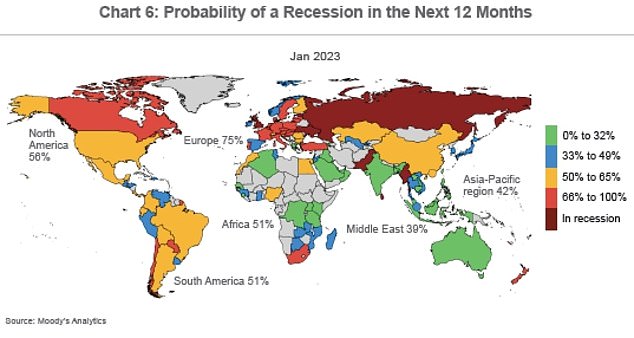

Credit ratings agency Moody’s Analytics says there is a one in three chance of a recession in Australia over the next year, compared with a 66 to 100 percent chance in New Zealand.

The Commonwealth Bank, Westpac, ANZ and NAB all expect a quarter percentage point rate hike next month, following the release of official inflation data for the December quarter on Wednesday.

Under this scenario, a borrower with an average mortgage of $600,000 would see their monthly payments increase by $93 to $3,303, up from $3,210.

A couple in Sydney with a $1 million home loan would see their payments increase by $154 to $5,504 from $5,350.

Both increases are based on a Commonwealth Bank variable increasing to 5.22% from 4.97%, to reflect the RBA cash rate increase to 3.35% from 3.1%.

Smith said the Reserve Bank should hold interest rates even though inflation is now well above its 2 to 3 percent target.

“There is an Everest of evidence to suggest that interest rates should be on hold from here on out,” he said.

Inflation in the year to September rose 7.3 percent and the Reserve Bank expects data for the December quarter to show an annual consumer price index rise of 8 percent, a level not seen since 1990. .

Moody’s Analytics still rates the chance of a recession in Australia over the next 12 months as a zero to 32 percent chance, compared with a 66 to 100 percent chance in New Zealand.

Westpac expects Australian Bureau of Statistics figures to show a more moderate pace of headline inflation of 7.4 percent in the year to December.

Chief economist Bill Evans said while global supply constraints are likely to be eased, higher wages would still keep inflation high as consumers also battled higher gas and electricity prices.

“Wage inflation in Australia is still rising as labor markets remain tight through the first half of the year,” he said.

Westpac expects rate increases in February, March and May that would take the Reserve Bank’s cash rate to an 11-year high of 3.85 percent.

The Commonwealth Bank, Australia’s largest mortgage lender, expects the February rate hike to be the last during this tightening cycle.

But the CBA’s Australian economics chief, Gareth Aird, expects inflation to peak at 7.7 percent by the end of 2022.

“We expect inflationary pressures to ease relatively quickly in 2023. But the annual rate still has to go higher,” he said.

Deloitte Access Economics expects inflation to moderate to 7.2% by June 2023 and return to 3.9% in 2023-24.

The Commonwealth Bank, Westpac, ANZ and NAB all expect a quarter percentage point rate hike next month, following the release of official inflation data for the December quarter on Wednesday (pictured, the building of the Reserve Bank of Australia in Sydney)

Last year, the Reserve Bank raised interest rates eight times, marking the most severe pace of tightening since it began publishing a target cash rate in 1990, and only put them on hold in January because that’s the only month that does not meet

If a recession were to occur in 2023, it would mark the first interest rate-driven economic contraction since 1991.

Australia’s 29-year run without a recession was cut short in 2020 by national Covid lockdowns before the Reserve Bank cut the cash rate later that year to a record low of 0.1 per cent.

Reserve Bank Governor Philip Lowe promised in 2021 to hold interest rates until 2024 ‘at the earliest’ only to raise rates in May 2022 for the first time since November 2010.

In a sign that inflation may have peaked, used car prices since May have fallen by 12 percent following a decline in a global shortage of computer chips that hampered car production. December data from Datium Insights and Moody’s Analytics showed.

“The decline is driven by higher new vehicle supplies as semiconductor shortages ease,” he said.

Rising interest rates would also make Australians less inclined to pay a premium for a used car, with a 10 per cent drop expected by 2023.

“In addition, rising auto-related loan interest rates could drive certain potential car buyers out of the market or shift their preference to cheaper vehicles,” Moody’s Analytics said.

“Demand for new and used vehicles will weaken through 2023. Australian households are under pressure from rising borrowing costs.”