ATO scam that Australians need to know about

>

Urgent Warning About A Cruel New ATO Scam That’s Very Hard To Spot: Here’s How To Avoid Getting Scammed

- Criminals are infiltrating the ATO Facebook page

- They pose as representatives of the tax office.

- The ATO never asks for personal information on Facebook

Australians have been warned to be on high alert over a devious scam in which criminals pose as Australian Taxation Office (ATO) workers.

The federal government has sounded the alarm that scammers are posing as tax office agents on Facebook, Twitter and other social media platforms to gain access to people’s information.

The fraud begins when scammers sneak into the comment sections of the tax office’s Facebook page to find potential victims.

Using fake ATO profiles, they directly contact taxpayers who have complained or asked questions online, offering to solve their problems.

Having earned your trust, criminals ask taxpayers to click on a link that requests personal information.

Australians have been warned to be on high alert over a devious scam in which criminals pose as the Australian Tax Office.

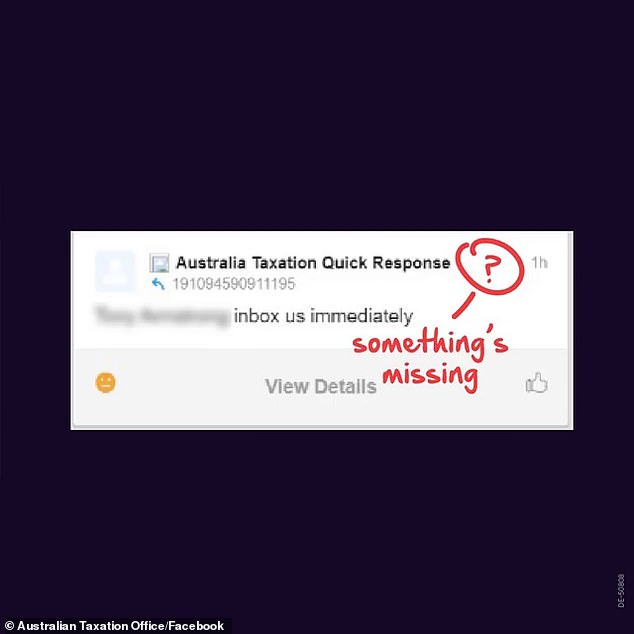

The ATO posted a video on its Facebook page explaining an important difference between its posts and scammers’ messages on fake ATO profiles: the dubious ones are missing a check mark.

In response, the ATO posted a video on its Facebook page explaining that scammers can be recognized because they do not have Facebook’s official blue check mark next to their title.

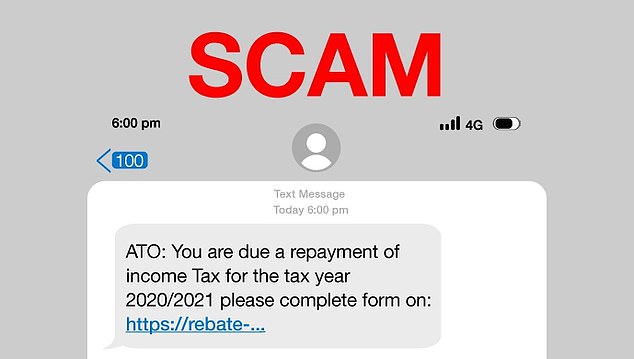

The cruel hack is the latest in a growing list of ATO scams that cyber crooks continually attempt. Others include false messages about tax refunds, tax debt, and retirement.

Deputy Treasurer Stephen Jones described the scam as “insidious” because of how convincing the fake ATO profiles are.

He said Australians should use “extreme caution” when interacting with the ATO on social media.

Mr. Jones clarified how people can protect themselves against fake ATO scams.

“The tax office will never ask for personal information via social media and will never send links that ask you to fill in your personal information, such as your tax file number, myGov login or bank account details,” it said. .

Scammers have spoofed ATO communications for several years as they try to deceive the public.

Scam methods include: dubious tax refund SMS messages, fake tax filing emails, retirement-related phone and email scams, and bullying calls threatening legal action if a tax debt is not paid. pay immediately.

The ATO urges anyone who believes they have received a bogus phone call, SMS, voicemail or email from the ATO not to respond.

Instead you should: call the ATO on 1800 008 540, or go to the tax office vverify or report a scam page to see how to spot and report a scam.