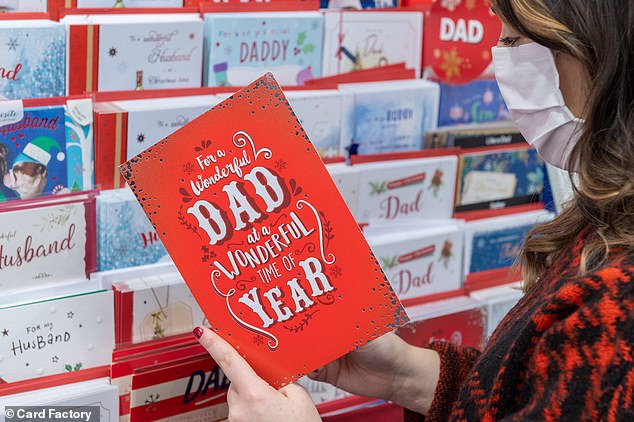

Card Factory boosts earnings forecast again as customers return to the high street

>

Card Factory raises profit forecast again as retailer shrugs off chaos of Royal Mail strikes in key Christmas period

- Card Factory expects to generate at least £106 million in underlying annual profit

- Mail strikes and the lack of Covid-19 restrictions hit the company’s online trading

- Both the company’s everyday cards and complementary assortments performed strongly

<!–

<!–

<!–<!–

<!–

<!–

<!–

Card Factory has raised its annual profit forecast for the second time in two months as customers flock to the retailer’s stores.

The greeting card and gift retailer now expects to generate at least £106 million in underlying revenue for the 12 months ended January, resulting in a pre-tax profit of around £48 million.

In November, the group raised its full-year core profit expectations by £7.2m to £96.9m, reflecting better-than-expected trading volumes.

Upgrade: Card Factory now expects to generate at least £106m of underlying revenue for the 12 months ended January, resulting in a pre-tax profit of around £48m

The company’s performance has continued to recover well in recent months, despite Royal Mail’s strikes during the important Christmas period hurting online sales.

Card Factory said sales benefited from the affordability of its festive seasonal range, as well as consumers buying more frequently and placing larger orders.

This helped store sales grow 7.1 percent on a like-for-like basis in the 11 months to December, as did healthy sales of the company’s complementary and everyday card offerings.

In the former category, double-digit sales growth was achieved for wedding, milestone, life moments and children’s cards and impressive displays of confectionery and pocket money toys in the latter segment.

“We are pleased and encouraged by the continued strong performance of the company,” said chief executive Darcy Willson-Rymer.

“As the execution of our growth strategy progresses well, it is great to see some of the benefits of this work reflected in our financial performance.”

The Wakefield-based company has strengthened its range, recently adding gift experiences, alcohol, flowers and confectionery to the items sold on its website.

While online sales fell 27.6 percent during the reported period, they’ve still risen 85.2 percent over the past three years due to significant growth at the height of coronavirus restrictions.

With card and gift shops classified as ‘non-essential’ by the UK government, Card Factory was forced to close its shops for much of 2020 and 2021, causing serious damage to its business.

As a result, the group nearly broke its bank covenants, until it finally agreed a £225 million refinancing package with lenders.

Card Factory Shares was up 5.1 percent by mid-afternoon Tuesday to 91.6 pence, their highest since May 2021, making it one of the best risers on the FTSE Small Cap Index.

Russ Mold, director of investment at AJ Bell, said: “Card Factory has been on a roll for quite some time, suggesting that its value proposition is resonating with cash-strapped consumers.

‘In difficult times, sending someone a card and/or a small gift can seem even more special than in ‘normal’ times.

‘While someone like WH Smith charges £3 or £4 for a greeting card, Card Factory offers them at a fraction of that price. It may not matter that the quality of the card is inferior; it’s about the gesture of giving.’