What to do if you face a mortgage shock as your fixed rate ends

>

More than 1.4 million people face a mortgage shock as they have to re-mortgage this year as fixed deals at low rates come to an end

According to statistics from ONS, nearly six in ten deals (57 percent) due to renew in 2023 have a rate of less than 2 percent.

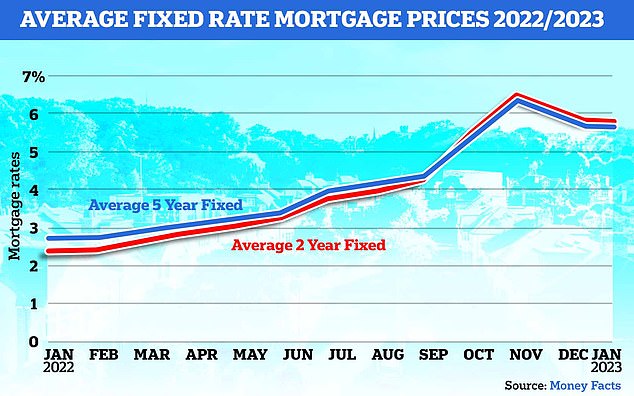

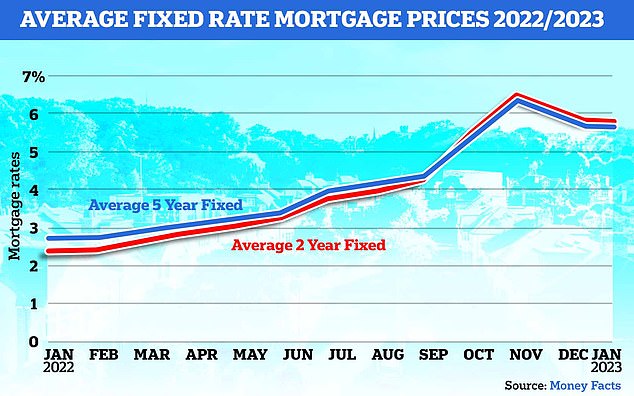

With an average two-year fixed rate now at 5.75 per cent and a five-year fixed rate at 5.57 per cent, many borrowers could face monthly bills of hundreds of pounds more.

Homeowners who know their mortgage agreement is due for renewal this year are urged to plan ahead, we explain what they can do.

More than half of homeowners due to take out a new mortgage this year have interest rates below 2%

What happened to mortgage interest?

Last year was a turbulent year for mortgages, not more than in the wake of then Prime Minister Liz Truss’s mini-budget in September.

While mortgage rates were already rising gradually due to high inflation, the surprising list of unfunded tax cuts that pushed up UK government bond yields and fueled fears of major emergency interest rate hikes pushed costs up further.

On August 1, 2022, the average two-year fixed mortgage rate for all deposits was 2.52 percent, according to data from Moneyfacts.

The figure peaked at 6.65 percent on October 20, and the five-year fixed rate peaked at 6.51 percent on the same day.

However, the average fixed interest rate for both two and five year mortgages has been falling steadily, despite a series of base rate hikes by the Bank of England in an attempt to tackle the high level of inflation. Average fixed-interest mortgages are now 5.75 percent and 5.57 percent over two and five years, respectively.

How much is this going to cost people

A wave of two-year fixed-term mortgages during the pandemic real estate boom is set to be extended this year, along with other two-year deals that have people re-mortgaging in 2021 at low rates.

Meanwhile, those who thought longer term in 2018 are also looking at the need to re-mortgage five-year fixes that are coming to an end.

Two years ago, the average fixed interest rate for two years was 2.52 percent, now it is 5.75 percent.

For a borrower re-mortgaging this month from an average two-year fixed deal on a £200,000 mortgage over 25 years, the average monthly increase would be £359. You can check the costs with our real cost mortgage calculator.

The best mortgage offers are significantly below the average quoted rates and many of those with larger deposits will have rates set well below 2 percent.

Fixed rate deals that expire in 2024 are likely to create fewer financial shocks because borrowers with two-year deals that are fixed in 2022 when interest rates were higher.

Not only mortgage holders will suffer this year. ONS data shows that 26 percent of all renters said their rent has increased in the past 6 months and that on average 24 percent of their weekly spending is on rent.

In contrast, only 16 percent of mortgage holders’ expenditure goes to repayments.

Slowly declining: Mortgage rates slowly fall from October post-mini budget highs, but remain much higher than early 2022

How will this affect homeowners?

The mortgage shock comes on top of energy bills that are more than twice what they were a year ago and other essentials like food that have seen big price increases as inflation soared.

Last year, more than a quarter of mortgage holders said they wouldn’t be able to pay their monthly repayments if they increased by £100 a month, according to research from Citizens Advice.

Morgan Wild, head of policy at Citizens Advice, said: ‘Rising interest rates will only exacerbate pressure on people’s already frayed budgets, draining their resources and resilience.

“People with expiring fixed-rate mortgages and people with variable-rate mortgages will already feel the pressure. Meanwhile, private tenants are increasingly exposed to costs passed on to them through rent increases.

“We know that people find it difficult to turn to lenders for help when they are struggling with repayments. That is why banks should take the first step and ask customers if they need support at the end of a mortgage with a fixed term.’

Mortgage interest rate falling?

There is good news, lenders are still lowering their prices. Last week, Nationwide announced cuts to 0.6 percent of its mortgage offerings, pushing some lending rates below 4.5 percent.

In our What now for mortgage interest? guide.

The prospects for tenants are less hopeful. Experts warn that rents will continue to rise as the rise in mortgage rates on rental properties is passed on.

The average rent in the UK was £1,174 a month in December 2022, down 0.1 per cent or £1 from the previous month, according to the latest rent index from landlord insurance broker HomeLet.

>> What to do if you are having trouble paying your mortgage payments

What to do if you need to borrow again

Borrowers who need to find a mortgage because their current fixed-rate contract is about to expire, or because they have agreed on a home purchase, should explore their options as soon as possible.

This is Money’s best mortgage interest calculator powered by L&C that can show you deals that match your mortgage and property value

Borrowers should compare rates and speak with a mortgage broker and be prepared to trade to secure a rate. Most lenders allow people to close a deal up to six months in advance.

Most mortgage agreements allow fees to be added to the loan and are not charged until it is closed. By doing this, borrowers can secure a rate without paying expensive arrangement fees.

Then, if rates continue to fall, they may be able to look for another deal without incurring any costs for not following through on their original plan. Borrowers should always check with their broker as circumstances may vary.

Anyone with a fixed rate deal expiring in the next six to 12 months should research how much it would cost them to re-mortgage and plan ahead with their finances to keep the cost rising.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and use it for free. We do not write articles to promote products. We do not allow any commercial relationship to compromise our editorial independence.