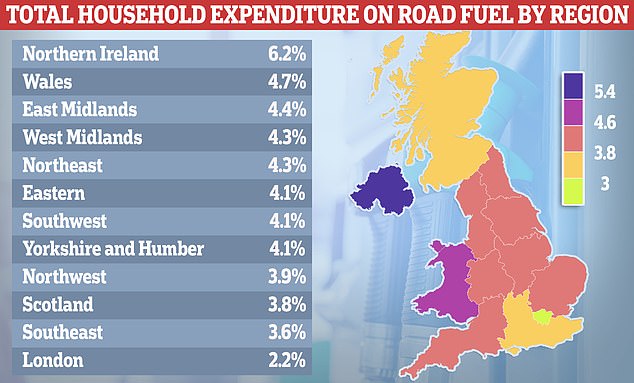

UK map of 12p-per-litre fuel duty rise

>

At the pump: UK map shows where drivers will be hardest hit by fuel duty hike of 12 pence per liter in March

- Fuel duty could rise by 12 pence per liter this spring, an increase of 23 percent

- Analysts say the tax increase will ‘disastrously hurt’ drivers outside London

- Residents of the East Midlands, West Midlands and North East will be hardest hit

<!–

<!–

<!–<!–

<!–

<!–

<!–

Drivers outside London will be hit hardest by Jeremy Hunt’s proposed 23 per cent increase in fuel duty in March this year.

Fuel duty could rise by 12p a liter this spring and drivers outside the capital who spend twice as much on petrol as Londoners will be ‘disastrously hurt’, analysis found.

According to data collected by FairFuelUK, residents of the East Midlands, West Midlands and the North East are expected to be most affected by the rise.

Analysts predict that the fuel tax increase will wreak economic havoc by adding 2.3 percent to inflation, reducing GDP by 1 percent and resulting in 31,000 job losses.

Fuel duty could rise by 12p a liter this spring and drivers outside the capital who spend twice as much on petrol ‘hurt disastrously’ as Londoners, analysis found

London households spend 2.2 per cent of their expenditure on petrol pumps, FairFuelUK researchers revealed to MailOnline.

But more than 90 per cent of all household fuel expenditure takes place outside the capital and in all other regions motor fuel expenditure as a percentage of expenditure is at least 50 per cent higher than in London.

Households in the East Midlands spend 4.4 percent of their expenditure on petrol.

Those living in the West Midlands and the North East spend 4.3 per cent of their money on fuel.

FairFuelUK founder Howard Cox also labeled the tax increase as ‘regressive’, arguing that the poorest 10 per cent of the population spend more than twice as much on fuel as the wealthier groups.

The poorest tenth of drivers spend 7.2 percent on fuel, compared to 3.3 percent among the richest tenth, data shows.

“The Chancellor’s planned crippling 12p excise increase announced by the OBR is not only disastrous for the nation’s economic recovery, it will also have disastrous consequences for drivers living outside the planet of London,” Cox claimed.

“The capital’s fiscal decision-makers do not understand that other parts of the country consume much more fuel per capita.”

Mr Hunt will make his final decision on a fuel tax increase in his March 15 budget.

Households in the East Midlands, West Midlands and the North East are expected to feel the brunt of the increase

The proposed petrol tax increase comes as the UK grapples with a cost-of-living crisis that has caused skyrocketing inflation and skyrocketing utility bills.

Households across Britain are also being penalized with a ‘hidden tax’ on their utility bills amounting to billions of pounds to pay for bailing out dozens of electricity and gas suppliers.

The levy could rise further if more companies go bankrupt.

Campaigners have condemned the hikes in the levy, which have surged over the past 12 months.

The levy traditionally covers the day-to-day costs of connecting customers to their gas and electricity supplies and maintaining networks.

But amounts have increased by almost 50 per cent on average over the past year – from an average of £186 to £273.

The increase is believed to be over £2 billion for all bill payers.

The levy is a stand-alone levy and should not have been affected by the massive increases in wholesale energy prices worldwide, exacerbated by the Russian invasion of Ukraine.

However, the fee increases were approved by industry regulator Ofgem to cover the costs of the market’s failed regulation, which led to around 30 companies going out of business in recent years.

Most damagingly, campaigners claim the charge is regressive – with money-poor retirees living alone and frugally being forced to pay as much as millionaires in large, well-heated homes.