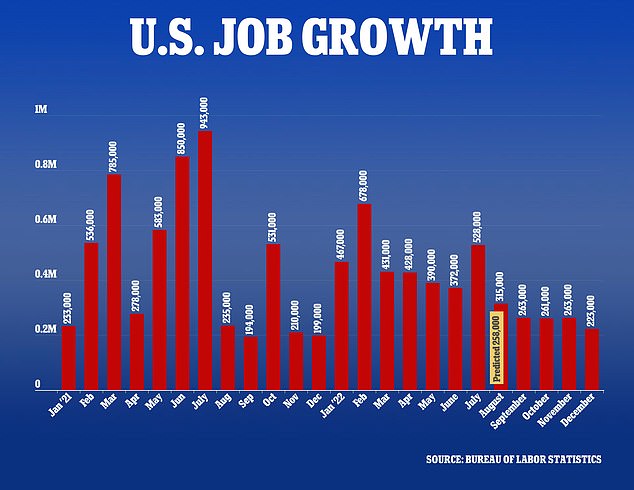

US hiring slows to the lowest level in two years with 223,000 jobs added

>

BREAKING NEWS: US hiring slows to lowest pace in two years: 223,000 jobs added in December with wage growth slowing, showing signs that high employment rates interest are limiting employment

<!–

<!–

<!–<!–

<!–

<!–

<!–

The United States added 223,000 in December as hiring cooled to a two-year low and wage growth slowed from November.

The unemployment rate fell to 3.5 percent from 3.6 percent, back to the lowest point before the pandemic, in signs the job market is resilient.

But the slower hiring rate showed signs that high interest rates are reining in employment amid recession fears and as record inflation begins to show signs of falling.

Economists had forecast that the United States would add 200,000 jobs in December.

Average hourly earnings rose 0.3 percent, about half the 0.4 percent increase last month. That cut the year-on-year rise in wages to 4.6 percent from 4.8 percent in November.

The US added 223,000 in December as hiring cooled to a two-year low and wage growth slowed from November.

The unemployment rate fell to 3.5 percent from 3.6 percent, back to the lowest point before the pandemic.

Government data this week showed that there were 10.458 million job offers at the end of November, which translated to 1.74 jobs for every unemployed person.

The job market has remained strong, despite the fact that the Fed embarked last March on its fastest interest rate hike since the 1980s.

Interest rate-sensitive industries such as housing and finance and technology companies including Twitter, Amazon and Facebook parent Meta have cut jobs.

However, airlines, hotels, restaurants and bars are desperate for workers as the leisure and hospitality industry continues to recover from the COVID-19 pandemic.

Labor market resilience is propping up the economy by supporting consumer spending. But it increases the risk that the Fed will raise its interest rate target above the 5.1% maximum that the US central bank projected last month and keep it there for a while.

However, the trend in job growth could slow significantly by mid-year as costly credit weighs on consumer spending and ultimately business investment.

Last year, the Fed raised its policy rate by 425 basis points from near zero to a range of 4.25 percent to 4.50 percent, the highest since late 2007.

Last month, he projected at least an additional 75 basis points of increases in borrowing costs by the end of 2023.