Finance pro Victoria Devine shares the two money mistakes thousands of couples make and how to avoid

>

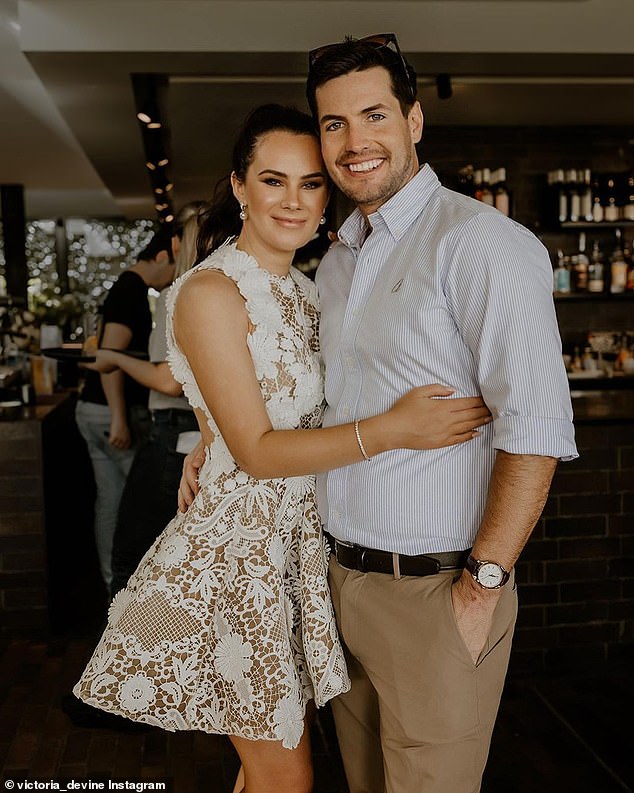

An Australian finance guru who was on the Forbes 30 under 30 list in 2021 has shared the top two mistakes couples make and how you can avoid them to succeed financially this year.

Victoria Devine, from Melbourne, is the host of the popular podcast she is in the money podcast, and also works as a wealth management consultant dedicated to making financial jargon understandable and relatable.

In one of her most recent posts, Victoria said there are two mistakes many couples make, and both have to do with getting married.

An Australian finance guru who was on the Forbes 30 under 30 list in 2021 has shared the top two mistakes couples make and how you can avoid them (Victoria Devine pictured)

The first is that couples don’t often plan for the adjacent occasions and celebrations around a wedding, which add up quickly.

While the second is that they don’t have a “shit fund” which means you have to have a little extra money set aside for when things go wrong.

“We think there are two important things people do with their wedding budget,” Victoria posted in instagram.

“But luckily for you, those are two things that are very easily fixed with a little bit of advance planning.”

Victoria (pictured with her husband) said you need to factor wedding-adjacent celebrations into your budget, as well as make sure you have a “shit fund” for emergencies.

1. Factor wedding-adjacent celebrations into your budget

The first thing Victoria said couples planning a wedding should do is consider “celebrations adjacent to the wedding.”

“Many people skip including things like the engagement party, bridal shower, dollar party, tea in the kitchen and the night before the wedding in their wedding budget,” she said.

“But it really should be there, as those celebrations can end up costing a LOT.”

To give yourself a true idea of where you stand with the cost of your wedding, the financial adviser recommends “painting a better financial picture of the entire wedding.”

This will prevent you from freaking out when you check your bank account at the end of the paperwork.

Victoria (pictured) said a ‘fucked up fund’ means you’ll always have a few extra dollars for a financial emergency and won’t be scared of spending.

2. Having a ‘shit bottom’

The second thing to think about when planning a wedding is to plan for the unknown or the unpredictable.

“While we hope nothing goes wrong on your wedding day, taking inspiration from the past two years of COVID chaos, it’s good to factor in a bit of surplus cash for any drama,” Victoria said.

“Think a last-minute alteration to a dress, the wet-weather panic of buying 40 umbrellas, or a few extra bucks to pay the photographer to stay overtime to capture some fun shots of your family on the dance floor.”

The adviser said it’s always a good idea for couples to have ‘f**k funds’ of extra money ‘saved up’ so they never panic.

Victoria (pictured) shared the six separate bank accounts she needs, including the cash center, food, fuel and fun account, two emergency funds, a short-term and long-term savings account

Earlier, Victoria shared the six separate bank accounts that will help you spend and save, without feeling deprived.

“It’s very personal how many bank accounts you have, but personally I always suggest clients have at least six in their possession so they can stay on top of their budget and cash flow,” Victoria told FEMAIL.

The six separate accounts include one called a ‘cash center’, another for ‘food, fuel and fun’, an ’emergency fund’, a bank account for ‘short-term savings’, one for ‘long-term savings’ and another ’emergency fund’ for other last-minute situations.

“The two most important of these accounts are the cash center, so you don’t mindlessly spend everything that goes into your account, and the emergency fund, so you’re not tempted to dip into it,” Victoria said.

For more information on Victoria Devine, visit her website here.