Two-thirds of economists at biggest banks predict a recession in 2023

>

Two-thirds of economists at the largest US financial institutions believe a recession will hit in 2023, according to a new survey.

The Wall Street Journal A survey of 23 primary dealers, the large financial firms that do business directly with the Federal Reserve, found that most expect a recession in the coming year.

Major economic concerns cited include declining personal savings, a slumping housing market and tightening lending standards at many banks.

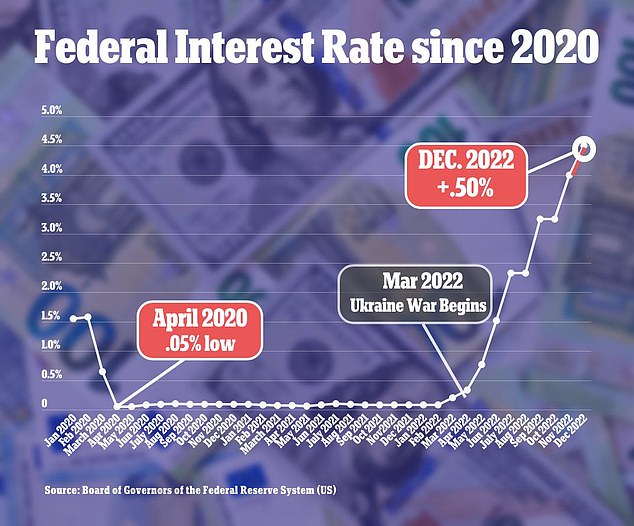

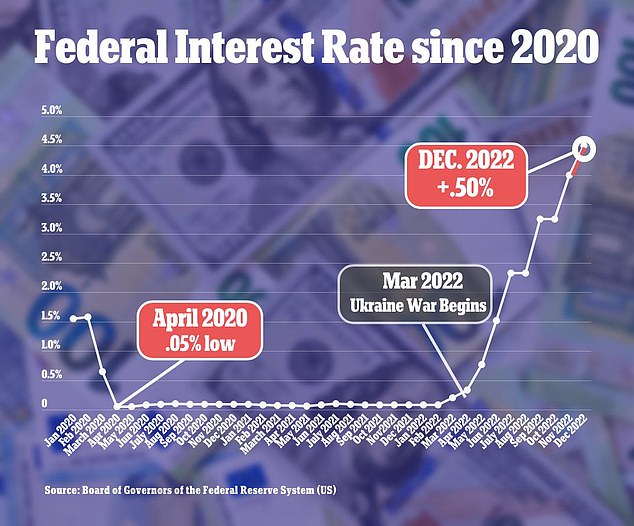

It follows the Fed’s rapid rate hikes to combat soaring inflation last year, in which the benchmark rate rose from near zero in March to a range of 4.25 percent to 4.5 percent at the end of year.

Most economists at the biggest banks, including Bank of America, Barclays and UBS, predict a recession in 2023 amid mounting warning signs.

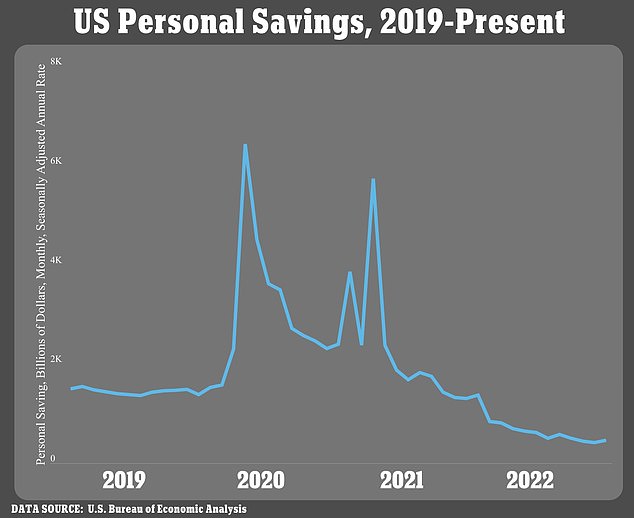

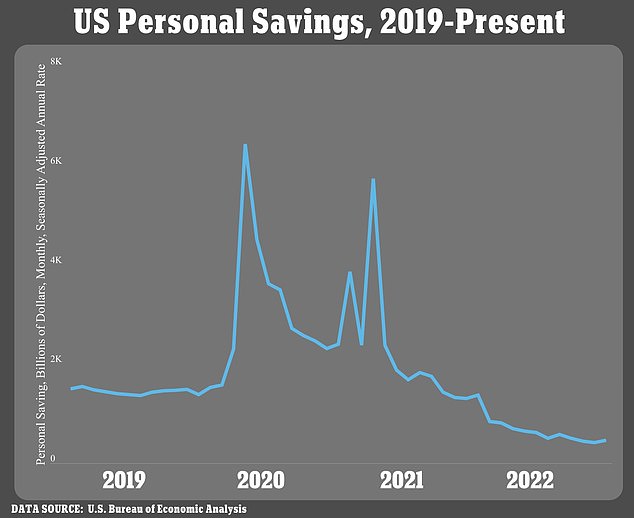

Rising prices have forced consumers to quickly spend savings, which skyrocketed during the COVID-19 pandemic

The Fed rapidly raised interest rates in 2022 to combat inflation, raising recession risks

The central bank forecasts that it will reach a range of 5 percent to 5.25 percent by the end of 2023. Its forecast does not call for a rate cut before 2024.

The Fed’s policy rate is now at its highest level since before the 2008 recession, as the central bank tries to reduce inflation without triggering an economic downturn.

By the Fed’s preferred measure, inflation is still nearly tripling its 2 percent target, having risen by early 2022 at its fastest pace in 40 years.

Rising prices have forced consumers to quickly spend their savings, which skyrocketed during the COVID-19 pandemic thanks to stimulus measures and a slowdown in spending.

The consumer price index rose at the fastest rate in 40 years earlier in 2022

The personal savings rate fell to 2.4 percent in November, well below the pre-pandemic average of 8.8 percent in 2019.

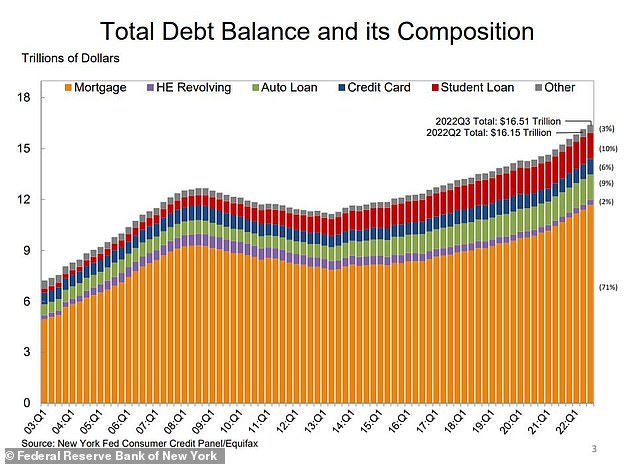

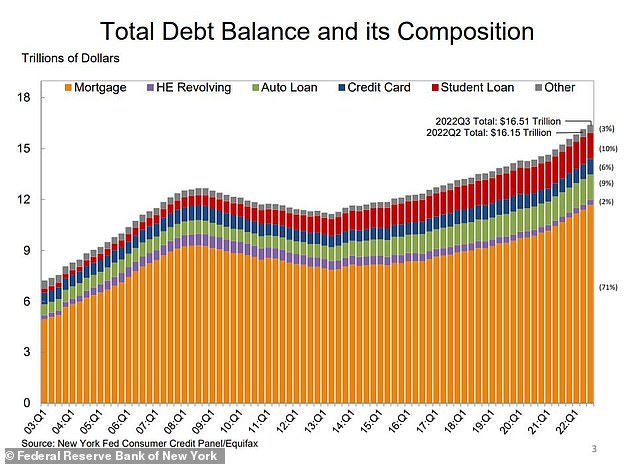

Consumers are also increasingly turning to lines of credit to make ends meet.

Total household debt reached $16.51 trillion in the third quarter, an increase of $351 billion from the prior quarter and a jump of 8.3% from the prior year, the fastest annual increase in 14 years, according to Fed data.

Higher interest rates have had the most dramatic impact on the housing market, which saw a drop in sales activity in the second half of last year.

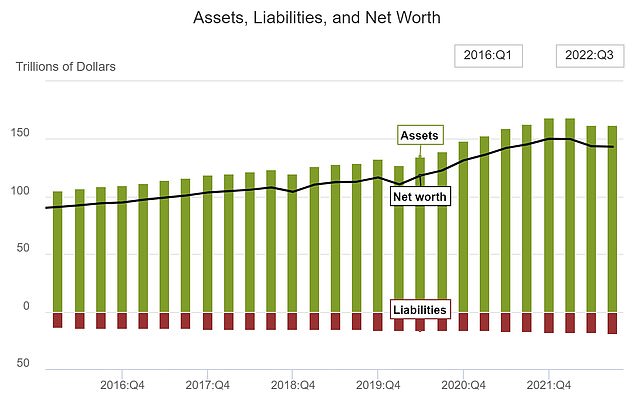

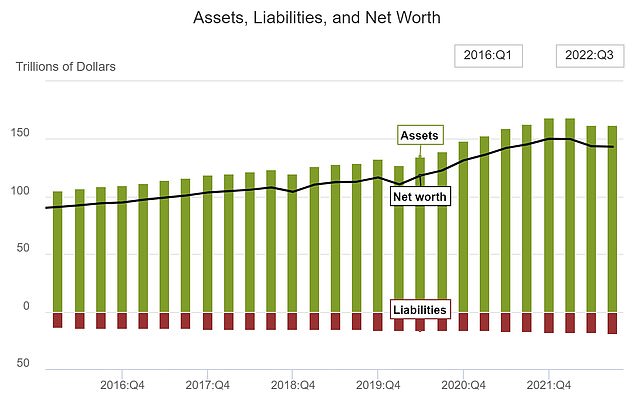

Household wealth (black line) fell another $400 billion in the third quarter, to $143 trillion, marking the third straight quarterly decline

Total household debt reached $16.51 trillion in the third quarter, an increase of $351 billion over the prior quarter and a jump of 8.3% over the prior year.

The 30-year fixed mortgage rate topped 7 percent in October for the first time since 2002, more than doubling in the span of nine months.

It has deflated a red-hot housing market fueled by record low borrowing costs and a rush to the suburbs during the pandemic.

Sales of existing homes fell 7.7 percent in November from October, according to the National Association of Realtors, and November sales fell 35.4 percent year-over-year.

The NAR added that the current ten-month streak of declines is the longest recorded in data going back to 1999.

Banks have also tightened their lending standards in recent months, a traditional leading indicator of a recession.

Existing home sales fell 35.4% from a year earlier. For a variety of reasons, including a doubling of the 30-year mortgage rate, Americans are holding back from buying homes.

Of the major traders surveyed by the Journal, only five said they don’t expect a recession in 2023 or 2024: Credit Suisse, Goldman Sachs, HSBC, JPMorgan Chase and Morgan Stanley.

Credit Suisse Senior US Economist Jeremy Schwartz wrote in the bank’s 2023 outlook: “Several historically reliable leading indicators are sending signals of recession, but in our view these measures cannot correctly measure recession risk in the global environment.” current”.

Indeed, the mixed signals from the economy since the pandemic have puzzled many economists.

The unemployment rate is still quite low at 3.7 percent. Fed policymakers project it to rise to 4.4 percent this year.

The stock market spent much of 2022 preparing for a downturn. The benchmark S&P 500 index ended the year with a loss of 19.4 percent.

It’s just its third annual decline since the financial crisis 14 years ago and a painful setback for investors after the S&P 500 posted a nearly 27 percent gain in 2021.

In total, the index lost $8.2 trillion in value, according to S&P Dow Jones Indices.