February Bank of England rates cut a ‘safe bet’ as growth stagnates and inflation falls

The Bank of England looks set to resume interest rate cuts next month after official data revealed weaker inflation and anemic economic growth.

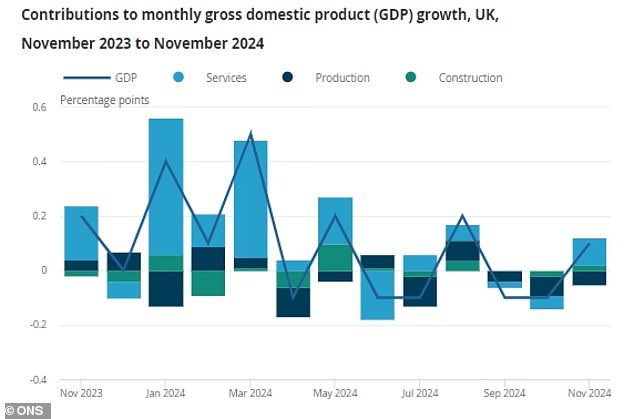

Economic output grew by just 0.1 percent in November, the Office for National Statistics said on Thursday, missing forecasts of 0.2 percent but marking a return to growth after two straight months of contraction.

Growth, which appears to have leveled off in the second half of 2024, was driven by the services and construction sectors, which offset a third consecutive monthly decline in industrial production.

Expectations for the pace and size of the BoE’s key rate cuts were gradually revised downwards in the second half of last year, as strong wage growth and inflation in the services sector weighed on the bank’s mission to consumer price index to the target of 2 percent.

The CPI, which has been above target for several months, fell from 2.6 percent in November to 2.5 percent in December.

Last year, the bank opted for two interest rate cuts of 25 basis points each, which would bring the base interest rate to the current level of 4.75 percent at the end of 2024.

Luke Bartholomew, deputy chief economist at abrdn, said: ‘With inflation softening yesterday, continued weakness in growth will prompt further easing from the Bank of England at its next meeting in February.’

However, he warned that it is “difficult to see” the bank “deviating from its ‘gradual’ mantra” towards “a faster easing cycle.”

Pressure on the BoE to cut key interest rates again now that growth is stagnating

Traders now expect a cut of two to three quarter points in 2025, bringing the base rate to a low 4 percent by the end of the year.

BoE Governor Andrew Bailey has spoken out about the possibility of a return to skyrocketing inflation.

Will 2025 mark another year of weak growth?

Thomas Pugh, British economist at RSM UK, agreed that the combination of weaker-than-expected inflation and economic growth “means a rate cut in February is now certain.”

He noted the improved performance of consumer-facing companies, suggesting that Britons are “gradually returning to spending more comfortably.”

However, Pugh warned that the economic outlook for this year remains precarious.

He said: ‘There are still good reasons to expect growth to pick up this year.

“The increase in government spending and investment announced in the budget should take effect and the first signs of a rebound in consumer spending should continue.

“But the lack of momentum entering the year increases risks that 2025 will fall short of expectations.”

The latest available forecasts published by HM Treasury show that the city expects inflation and GDP growth to average 2.5 and 1.3 percent respectively in 2025.

The services sector and the construction sector compensated for a new decline in production

UBS, HSBC and HSBC look the most bullish on GDP performance, predicting growth of 1.5 percent, while JP Morgan looks the most bearish with a forecast of just 0.8 percent.

The Office for Budget Responsibility predicts growth of 2 percent in October for 2025.

Scott Gardner, investment strategist at JP Morgan-owned Nutmeg, said weak sentiment towards Britain, “represented by recent instability in financial markets”, could “provide a headwind” to the country’s growth ambitions.

He added: ‘Despite this change in sentiment, the outlook for Britain is bright, with the economy forecast to grow faster than European economies including France and Germany by 2025.

‘A potential rebound in housing market activity ahead of April’s stamp duty changes could provide a boost to the economy.

“While we remain cautious about possible announcements of US trade tariffs, if they materialize they are expected to have a greater impact on Britain’s European neighbors.”

City’s forecasts for GDP growth in 2025

DIY INVESTMENT PLATFORMS

A. J. Bell

A. J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

Sax

Sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.