The pound plummets and government bond yields rise as Reeves faces new market turmoil

The pound fell for a fifth day in a row yesterday and the government’s long-term borrowing costs hit a new 27-year high, amid rising fears over Labour’s stewardship of the economy.

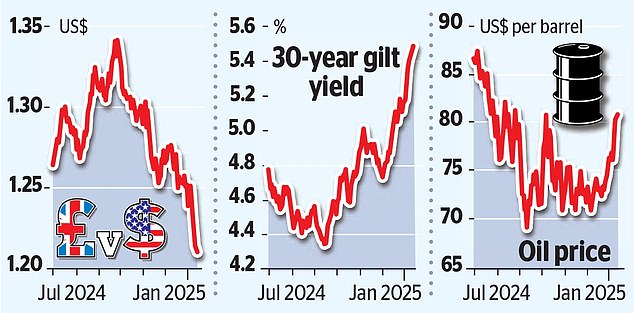

In another setback for Rachel Reeves as she returned to Britain after a trip to China, the pound fell by as much as a cent to a fourteen-month low of $1.21 against the US dollar.

The currency is 10 percent below its pre-budget peak in September and has fallen by almost five cents in just a week.

The pound also lost ground against the euro, falling below €1.19 to a two-month low.

And 30-year Treasury yields rose to nearly 5.5 percent, the highest level since 1998, while 10-year yields hovered around 4.9 percent, close to a 17-year high reached last week.

Gilts are bonds sold by the British government to raise money. When their prices fall, yields rise.

Slump: Pound is now 10% below its pre-Budget peak in September and has fallen by almost five cents in just a week

Higher yields mean investors demand higher returns on loans to Britain. In a further headache for ministers and the Bank of England hoping to keep inflation in check, the price of a barrel of Brent crude rose to $81.68, a five-month high.

The latest moves add to the turbulence seen in markets last week. This was triggered by jitters over US borrowing and inflation, but quickly turned investors against Britain amid doubts whether Reeves’ tax and spending plans would hold up.

The rise in bond yields has further limited the Chancellor’s options, adding an estimated £10 billion a year to the UK’s interest costs.

It will likely mean Reeves will have to cut spending or raise taxes again.

Kathleen Brooks, research director at broker XTB, said concerns about the UK’s public finances would continue until the government takes action to address these issues.

She said: ‘The bond market is trying to intimidate Chancellor Rachel Reeves into forcing Britain to live within its means.

‘We think the bond market will get its way.

‘The Labor government may be able to put Britain on a secure fiscal footing, but it may not do so in the way it wished when it came to power last year.

Public sector spending will run out in 2025. Rachel Reeves needs to recognize this before the bond market will calm down.”

Pressure: Chancellor Rachel Reeves may be forced to cut spending or raise taxes again

The turbulence comes as the Bank of England considers its next rate hike, with markets betting there will be two cuts this year, starting next month.

His decision is complicated by the prospect that the US Federal Reserve will have to slow down as Donald Trump’s trade and tax policies threaten to fuel inflation in America.

That could put pressure on the Bank of England to also take a break, as the prospect of interest rate cuts here and in the US much faster would increase pressure on the pound.

But experts believe the Bank may be forced to make faster cuts if growth prospects continue to deteriorate.

The latest market turmoil comes at the start of a big week for the economy, with inflation and gross domestic product (GDP) figures being released.

Tomorrow’s inflation figures are expected to show that it remained at a stubbornly high level of 2.6 percent in December, above the Bank’s target of 2 percent. British economist Sanjay Raja of Deutsche Bank said: “The specter of stagnation now looms large in Britain.”

DIY INVESTMENT PLATFORMS

A.J. Bell

A.J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

Sax

Sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.