UK borrowing costs rise to 27-year high: what are government bonds and how do they work?

Borrowing costs rose to the highest level in more than a quarter of a century this week, while government bond yields continue to rise.

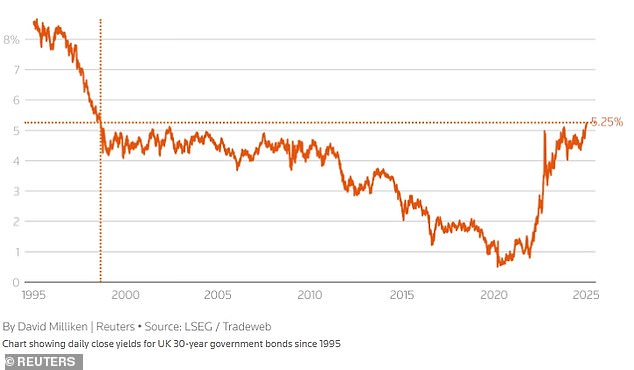

Just months after the budget, the yield on 30-year government bonds topped 5.25 percent on Tuesday for the first time since 1998 – and is now above 5.34 percent.

Meanwhile, the yield on ten-year government bonds has risen to 4.8 percent – the highest level since the financial crisis.

The rate of return, which measures how much it costs the government to borrow, is now higher than it was after Liz Truss’s mini-Budget, raising fears that it could also drive up the cost of borrowing for households and businesses.

So what are government bonds, why are they rising and what does this mean for households and the economy?

What are gilts?

The government generally spends more in taxes than it brings in, which means it has to borrow money.

It can do this by issuing government bonds – also called gilts – which act as an instrument of debt, but the government must pay interest on the loan.

Under pressure: Rachel Reeves could break her budget rules if Treasury yields continue to rise

They are considered a relatively safe investment because, like other bonds, the borrower promises to repay the loan after a fixed period of interest payments.

They also carry lower risk compared to other bonds, such as corporate bonds, because the issuer is the government.

The three main things to look at are the issuer (in this case the government), the coupon (the rate at which the issuer pays interest) and the term (the date the loan is repaid).

There are different types of UK government bonds, ranging from short term – between one and two years – up to 30 years.

The longer the investment lasts, the higher the yield, which is the annual return the investor receives if he holds it until maturity.

Why does the price of government bonds change?

Gilts trade like other investments so they can be bought and sold above or below the price at which they were issued.

This price changes depending on whether investors believe the government bond can be repaid within the specified period.

It also depends on where interest rates are set, and when central banks change the base rate, government bond prices usually change too.

Government bond prices and interest rates have an inverse relationship. When interest rates rise, government bond prices tend to fall.

This is because investors will find better returns elsewhere, including on new government bonds issued with higher coupons.

On the other hand, if interest rates are lowered, newer government bonds pay less interest, making existing government bonds look more attractive.

Government bond prices and government bond yields also have an inverse relationship. Falling government bond prices mean higher government bond yields, and as government bond prices rise, their yield falls.

For example, if a bond is issued for £100 with a 3p coupon, it has a yield of 3 percent. But if the price rises to £200, the coupon is still 3p, but the yield drops to 1.5 percent.

Why are government bond yields rising now?

Overall, the cost of borrowing around the world has risen due to the pandemic and Russia’s invasion of Ukraine, pushing inflation higher.

However, UK government bond yields have risen further as investors expect the Bank of England to cut rates by 0.5 percentage points, with inflation likely to remain above the 2 percent target.

There are questions about whether Britain can boost growth and keep inflation at bay.

Others have suggested that the spike in UK interest rates is a response to the government’s plans to increase borrowing. However, short-term debt has increased across the board.

Bond yields rose by 0.5 percentage points in the US and Great Britain, by 0.45 percentage points in Germany and by 0.40 percentage points in France.

This is largely a response to persistent inflation, which poses a particular threat to longer-term bonds, and to Donald Trump’s introduction of tariffs.

“If you hold a one-year bond, you might feel that if inflation takes hold again, it won’t be until at least the time when you can at least get your money back, and reinvest it at a possibly higher interest rate. interest rates,” said Laith Khalaf, head of investment analysis at AJ Bell.

‘If you are tied to a bond with a term of thirty years, it will take a long time before you can redeem your bond at face value. Any threat of inflation could therefore leave your investment in the red for a longer period of time.’

Yields on 30-year UK government bonds are at their highest point since 1998

Short-term debt has also risen in recent weeks, although not as quickly, mainly because “markets are concerned that Trump’s immigration and tariff policies could trigger a wave of inflation that pushes central banks to keep interest rates high for longer,” says Khalaf.

‘UK government bonds across all maturities have followed a similar path in recent months, although longer-term debt started from a higher base, which is why they are now rising above the levels we saw in the wake of the mini-budget.

“You would expect longer-term interest rates to be higher under normal circumstances because of the ‘term premium’ built into the yield curve. Investors who tie up their money for longer naturally demand a higher return.’

Analysts at Peel Hunt predict that the risks facing the global economy, and not just Britain’s, are ‘unusually high’, so ‘we may have to run further before bond markets calm down’.

What do higher government bond yields mean for investors and the economy?

Higher borrowing costs will make it harder for the chancellor to meet her borrowing target and could see her taxes rise in the spring.

Jason Hollands of Evelyn Partners said: ‘This is undoubtedly a blow to Chancellor Rachel Reeves, whose credibility with markets and business leaders has been damaged by the budget, as it signals a lack of confidence in Britain’s longer-term growth prospects. term. it also reflects the market adjustment for a significant amount of bond issuance in the coming year given Labour’s borrowing plans.

‘The rise in long-term interest rates poses a real challenge for the Chancellor when it comes to adhering to her budget rules.

“Ultimately, this will increase pressure for either greater spending restraint or the potential for further tax increases, neither of which will be acceptable to the public.”

If inflation and budget problems persist, the Bank of England could choose to cut interest rates even more slowly, which would lead to higher mortgage and credit costs.

Richard Carter, head of fixed rates at Quilter Cheviot, said: ‘The Bank of England remains cautious about cutting rates too aggressively, and tepid investor demand at the latest government bond sale underlines the uncertainty in the market.

“The near-term outlook is particularly unpredictable as we approach Trump’s inauguration, adding to volatility.”

Despite the turbulence, experts say government bond yields remain an attractive opportunity7 for long-term investors as they remain above expected inflation levels.

“For investors with a lower risk appetite, short-term government bonds still offer promising opportunities and are less sensitive to market fluctuations,” Carter says.

Hollands added: “Gilts look cheap compared to US government bonds, but if Donald Trump’s agenda of tax cuts and deregulation overheats the US economy and triggers a return of inflation, US government bond yields could eventually move higher.

‘At the moment, however, we think that nominal government bonds have an advantage over government bonds.

‘A simple way to gain exposure to the government bond market is through a low-cost passive fund such as the iShares Core UK Gilts UCITS ETF or the Vanguard UK Government Bond Index fund.’

DIY INVESTMENT PLATFORMS

A. J. Bell

A. J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

Sax

Sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.