Major upscale department store goes private in $6.25 billion deal

A major US department store chain is going bankrupt in a $6.25 billion deal that will see the founding family regain control.

Executives at Nordstrom announced Monday that Erik, Pete and Jamie Nordstrom, as well as the Mexican department store chain El Puerto de Liverpool, will acquire any remaining shares they do not own – giving the family a majority stake. CNN reports.

Shareholders will be compensated $24.25 for each share, which represents a premium of approximately 42 percent over the shares based on the price on March 18, 2024, when speculation about the company’s IPO first began.

The company said it would also approve a special distribution of up to 25 cents per share if the transaction closes. according to the New York Times.

“For more than a century, Nordstrom has operated on the fundamental principle of helping customers feel and look their best,” said CEO Erik Nordstrom.

“Today marks an exciting new chapter for the company. On behalf of my family, we look forward to working with our teams to ensure Nordstrom can continue to thrive in the future.”

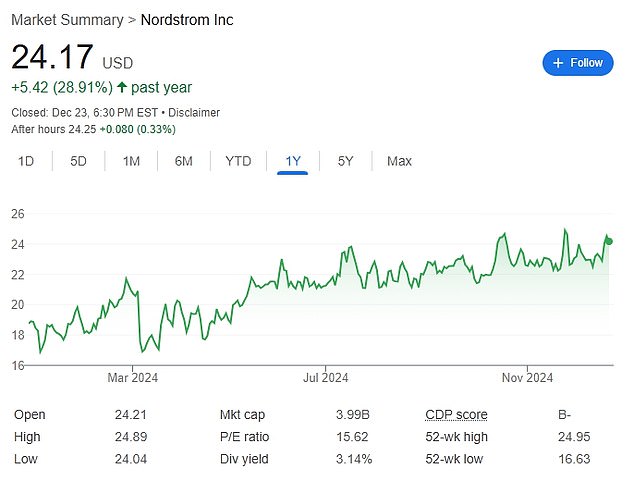

The department store’s shares fell more than a percentage point after the news, closing at $24.17 on Monday, but were still up more than 30 percent for the year as the company maintained a market value of just over $4 billion. according to the Wall Street Journal.

Yet the shares have languished for years after peaking at nearly $15 billion nearly a decade ago.

Executives at Nordstrom announced Monday that they are taking the department store private

The $6.25 billion deal will see the founding family and Mexican department store chain El Puerto de Liverpool acquire all remaining shares they do not own, giving the family a majority stake

The department store’s shares fell more than a percentage point after the news, closing at $24.17 on Monday, but were still up more than 30 percent for the year as the company maintained a market value of just over $4 billion.

When the Nordstrom family tried to take their namesake department store private in 2018, they offered shareholders $50 per share, but at the time the board said that was too low a price.

Much, if not all, of the decline can be attributed to consumers cutting back on discretionary spending after the pandemic and changing their habits to purchase more items online.

Other department stores are also feeling the pressure, as Macy’s comes under pressure from an activist investor to sell some of its real estate, including possibly its New York City flagship store.

The investors also asked Macy’s to sell Bloomingdale’s and Bluemercury, which operate under their banner.

They believe the property, which they value at $5 billion to $9 billion, is worth more than the department store’s retail operations.

With that in mind, Wall Street analysts have praised Nordstrom for its privatization plan.

For example, Neil Saunders, managing director of GlobalData, wrote that the family and El Puerto de Liverpool have the ability to make “necessary investments and changes outside of the short-term scrutiny of public markets.

“They will likely run the business like a retailer rather than some sort of financial play, which we think is very positive for the long-term health of the brand.”

Department stores are struggling as consumers cut back on discretionary spending and change their habits to buy more items online

Morningstar senior equity analyst David Swartz also said he believes “it’s a very good deal for the buyout group,” saying the department store is “undervalued at this price.”

“I also understand that there’s a reason why Nordstrom should probably go public, and that’s because investors just aren’t giving good valuations to department store companies right now,” he said.

Swartz went on to say that as the department store opens more Nordstrom Rack locations, “this is likely the future of the company, even though Rack is smaller than the main Nordstrom stores.”

“But Rack is probably better positioned for the type of retail market we have today,” he said.

The deal is expected to close in early 2025, but must first be approved by two-thirds of the company’s common shareholders.