2W electric player Ola Electric sets IPO price band at Rs 72-76 per share

Bhavish Aggarwal, CMD, Ola Electric Mobility Limited at the IPO Press Conference in Mumbai on Monday, July 29, 2024 | Photo: Kamlesh Pednekar

The country’s largest electric two-wheeler (e2W) player Ola Electric is going for the biggest initial public offering (IPO) of the year so far, aiming to raise Rs 6,146 crore ($734 million). About 150 companies in the country have already gone public this year in a bid to raise a total of $5 billion, double the amount raised during this period last year, according to estimates.

The Softbank-backed company has set a price band of Rs 72-76 per share for its initial share sale, which is expected to test the appetite for loss-making businesses of the new era. At the upper end of the price band, Ola will be valued at Rs 33,522 crore ($4 billion) on a post-diluted basis. The company’s IPO is scheduled to open on August 2.

Founder and CEO Bhavish Aggarwal, who is charting the path to profitability for Ola Electric, told reporters at the IPO press conference in Mumbai that volume growth and vertical integration would be the key pillars for improving the company’s margins.

Through the IPO, the Bengaluru-based company plans to issue new shares worth Rs 5,500 crore, which will be used to repay debt, expand its gigafactory and for research and development.

The Offer for Sale (OFS) portion of the issue is just Rs 646 crore, of which Aggarwal’s stake is Rs 288 crore. Around nine other investors are selling stakes, including Tiger Global (Rs 48 crore) and Softbank (Rs 181 crore). Alpine Opportunity and Tekne Private are selling small amounts at a loss as their acquisition cost is over Rs 111 per share.

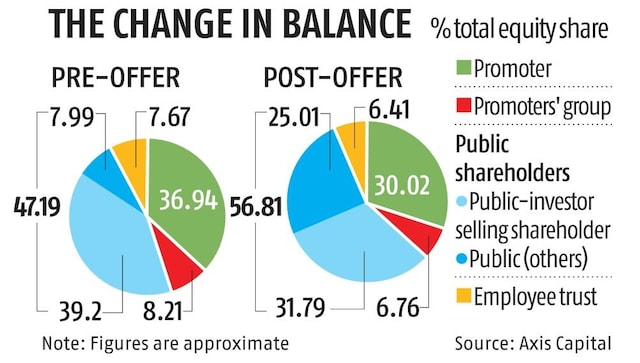

Post IPO, promoter shareholding in the company will come down from nearly 45 percent to 36.78 percent. Investment bankers said the pricing of the IPO is based on feedback from investors. They expect strong response from both domestic and foreign mutual funds. According to a Reuters report citing sources, the IPO is expected to attract bids from Fidelity, Nomura and Norges Bank, as well as several Indian mutual funds.

Aggarwal said, “The Indian EV story is still in its infancy. Three years ago, when we launched our products, I think the EV story started. We are only seeing the EV market growing. You are also seeing the established players, who said three years ago there was no EV story, also entering the segment.”

When asked about the decline in sales and even the global EV segment seeing a slowdown, Aggarwal said that like other industries, it would go through a cycle. “There will be cyclical ups and downs, either subsidy changes or some cyclical seasonal things,” he said.

Ola Electric’s gross margins improved from 5.4 percent in FY22 to 7.63 percent in FY23 and 16.47 percent in FY24. Volumes grew from 156,000 units in FY23 to 330,000 units in FY24.

Ola Electric is currently sourcing cells from third-party suppliers. It has started trialling at its Gigafactory in Tamil Nadu, where phase 1 of the project was completed in May (1.4 GwH capacity). It has developed a cell technology around the 4680 form factor for which it received BIS certification in May, which will be used in existing and future products. The Gigafactory will have a capacity of 20 GwH (in four phases). Ola Electric is also in line for the Cell PLI (production-linked incentive scheme). It has already received certification for the S1 Pro product under the PLI scheme and is currently filing initial claims with the Centre.

The company’s 2,000-acre EV centre in Tamil Nadu’s Krishnagiri and Dharmapuri districts, which houses its ‘futurefactory’ and gigafactory, along with co-located suppliers, will help drive greater efficiency.

Aggarwal said the company would start shipping motorcycles early next year. It had unveiled four motorcycle models – Adventure, Cruiser, Roadster and Diamondhead – last August. Meanwhile, the company plans to unveil more two-wheeler models on August 15.

As India expects to capture a larger share in two-wheeler exports, Aggarwal is betting big on Ola Electric for a smooth ride.

First print: Jul 29, 2024 | 11:51 PM IST